Shares in Snap Inc. (SNAP) dropped over 6% in extended market trading after its second-quarter loss widened and user growth figures disappointed.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

The stock declined to $23.17 in Tuesday’s after-market trading. Snap reported a net loss of $326 million, or 23 cents per share, in the quarter ended June, widening from $255.2 million, or 19 cents per share, in the year-earlier period. Meanwhile, total revenue increased 17% to $454 million during the reported period.

Daily active users (DAUs), a widely followed metric by investors and advertisers, increased 17% to 238 million in the second quarter year-on-year but fell short of analysts’ expectations of 238.44 million. For the current quarter, Snap expects 242 million to 244 million daily active users, below analysts’ estimates of 244.82 million.

“We continued to grow our community and business in a challenging and uncertain environment,” said Snap CEO Evan Spiegel. “We are grateful that the resilience of our business has allowed us to remain focused on our future growth and opportunity.”

Spiegel added that in the U.S. more than 100 million people are using Snapchat, and that the company is also seeing strong growth in core markets in North America, Europe and Australia. Even faster growth has been recorded in emerging markets like India, where the company has seen over 100% growth in daily active users over the past year, he said.

Revenue from advertising business grew 17% year-over-year to $454 million beating the $440.8 million forecast by analysts.

Looking ahead, Snap’s Chief Financial Officer Derek Andersen said third-quarter revenue growth was 32% through July 19.

Following the financial results, Rosenblatt Securities analyst Mark Zgutowicz lifted the stock’s price target to $30 (21% upside potential) from $23 and maintained a Buy rating.

“We raise our PT driven by increased forward revenue including CY20E $2.10B (roughly in-line with consensus) and a reduced equity risk premium, down ~20 bps from June levels,” Zgutowicz wrote in a note to investors. “With brands representing 40-45% of revenue and a still tepid brand messaging environment amid escalating health and economic uncertainties, we expect slow but steady brand spend improvement.”

The analyst expects “continued direct response (DR) momentum and ecommerce exposure will help offset some brand heaviness near-term”.

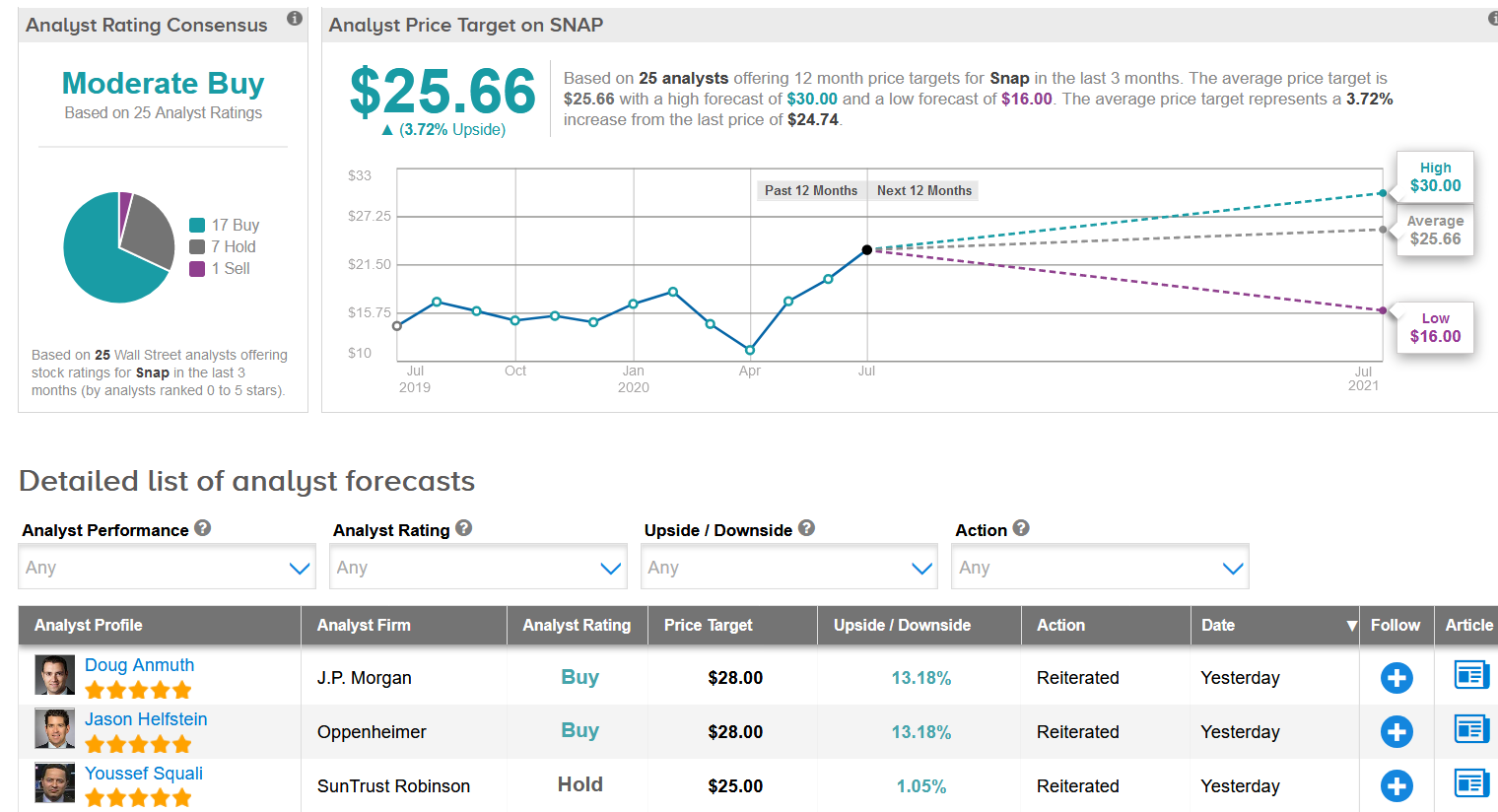

The rest of the analyst community has a cautiously optimistic outlook on the company’s stock. The Moderate Buy consensus shows 17 Buys versus 7 Holds and 1 Sell. With shares up a stellar 52% so far this year, the $25.66 average price target implies a modest 3.7% gain in the shares in the coming 12 months. (See Snap stock analysis on TipRanks).

Related News:

Apple Is Developing Its Own Graphics Cards- Report

Sony Invests $250M For Minority Stake In Fortnite Maker Epic Games

Synaptics Snaps Up DisplayLink For $305M In All-Cash Deal; Top Analyst Lifts PT