After a weak summer, semiconductor stocks are bouncing back in a big way. Nvidia (NVDA) CEO Jensen Huang reports that demand for the company’s new Blackwell GPUs is “insane,” Micron (MU) posted stellar earnings, and popular stocks in the space like Lam Research (LRCX) and Super Micro Computer (SMCI) just executed 10-for-1 stock splits. Super Micro Computer also grabbed the market’s attention by announcing it had recently deployed over 100,000 GPUs with its liquid cooling system.

Investors can invest in the semiconductor sector through ETFs in a variety of ways, and many of these employ different approaches to the space. With that in mind, let’s take a look at two different semiconductor ETFs with different strategies to determine which is the better choice for investors — the Van Eck Semiconductor ETF (SMH), or the SPDR S&P Semiconductor ETF (XSD).

A Closer Look at the Van Eck Semiconductor ETF (SMH)

With $24.1 billion in assets under management (AUM), SMH is by far the largest semiconductor-specific ETF in the market.

According to Van Eck, SMH invests in an index called the “MVIS US Listed Semiconductor 25 Index (MVSMHTR)”, which is intended to track the overall performance of companies involved in semiconductor production and equipment.” SMH’s “index methodology favors the largest companies in the industry.”

To be included in this index, companies must derive at least 50% of their revenue from semiconductors and semiconductor equipment. The index begins with the largest 50 semiconductor stocks by market cap, and then invests in the top 25 based on market cap and trading volume. The fund is classified as a non-diversified issuer and has the ability to invest a greater amount in a particular stock or subindustry, as we’ll see below.

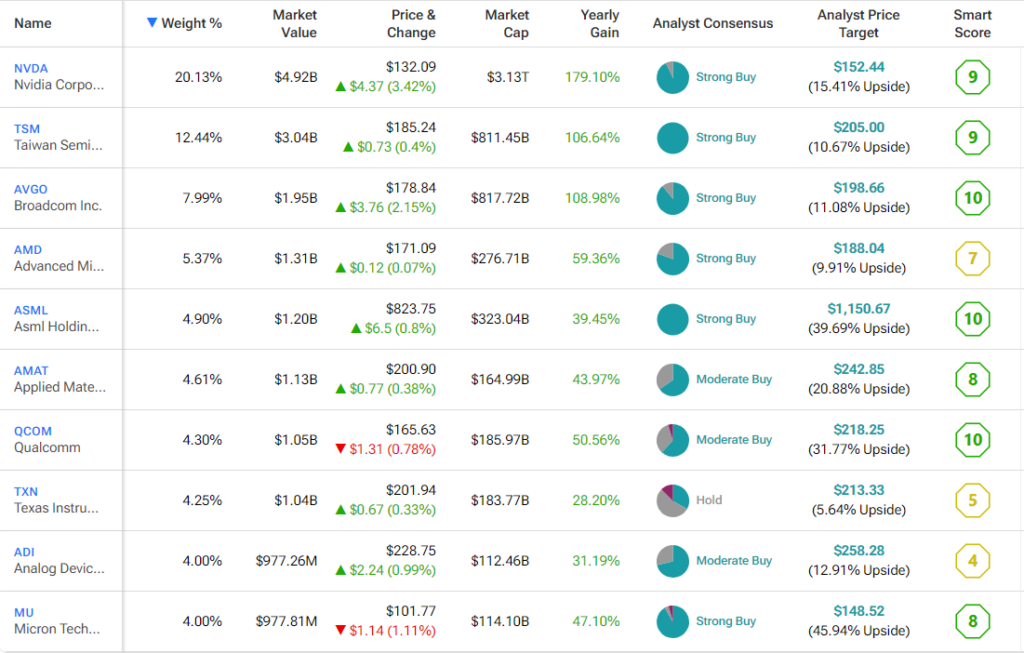

Because it is favoring the largest companies in the industry, SMH is not particularly diversified and represents a relatively concentrated bet on the largest semiconductor stocks. SMH only holds 25 stocks, and the fund is quite concentrated among its top positions; its top 10 holdings account for a relatively high 72.0% of assets. Below, you’ll find an overview of SMH’s top 10 holdings from TipRanks’ holdings tool.

SMH Holdings and Performance

As the table above indicates, SMH has a 20.1% position in industry leader Nvidia. While this is a lot of exposure to a single stock, the large stake in Nvidia has benefited SMH substantially as the mega-cap stock is up nearly 180% over the past year. A large position in one stock like this can increase investor risk, through a lack of diversification, but the gamble has paid off well for SMH so far.

It’s not just Nvidia that has a significant weighting within SMH. Taiwan Semiconductor (TSM) represents 12.4% of the ETF, which has also given SMH a helping hand due to TSM stock’s 100%+ return over the past year. Broadcom (AVGO), which has a experienced a similar return to Taiwan Semiconductor, has an 8.0% weighting.

The strong performance of these top semiconductor stocks has propelled SMH to excellent returns over both the short term and long term. This fund has outperformed the XSD ETF due to its overweight exposure to some of these high-flying companies.

As of the most recent monthly close (September 30), SMH’s total annualized return over the past three years stands at an impressive 25.3%. Over five years, it has a blistering total annualized return of 33.9%.

SMH charges an expense ratio of 0.35%, meaning that an investor in the fund will pay $35 in annual fees on a $10,000 investment holding.

Is SMH Stock a Buy, According to Analysts?

Turning to Wall Street, SMH earns a Strong Buy consensus rating based on 21 Buys ratings, five Hold ratings, and zero Sell rating assigned in the past three months. The average SMH stock price target of $291.50 implies about 15% potential upside from recent levels.

I’m bullish on SMH based on its incredible performance over the past three, five, and 10 years, its portfolio of high-performing semiconductor stocks, and its favorable analyst outlook.

A Closer Look at the SPDR S&P Semiconductor ETF (XSD)

SMH has set a high bar in this comparison. Now, let’s take a look at another relevant ETF within the space that operates under a different approach: the SPDR S&P Semiconductor ETF (XSD). Part of the popular Sector SPDR ETF series from State Street, XSD is smaller than SMH but still commands $1.3 billion in AUM.

XSD invests in the “S&P Semiconductor Select Industry Index,” a “modified, equal-weighted index which provides the potential for less concentrated industry exposure across large, mid and small-cap stocks.”

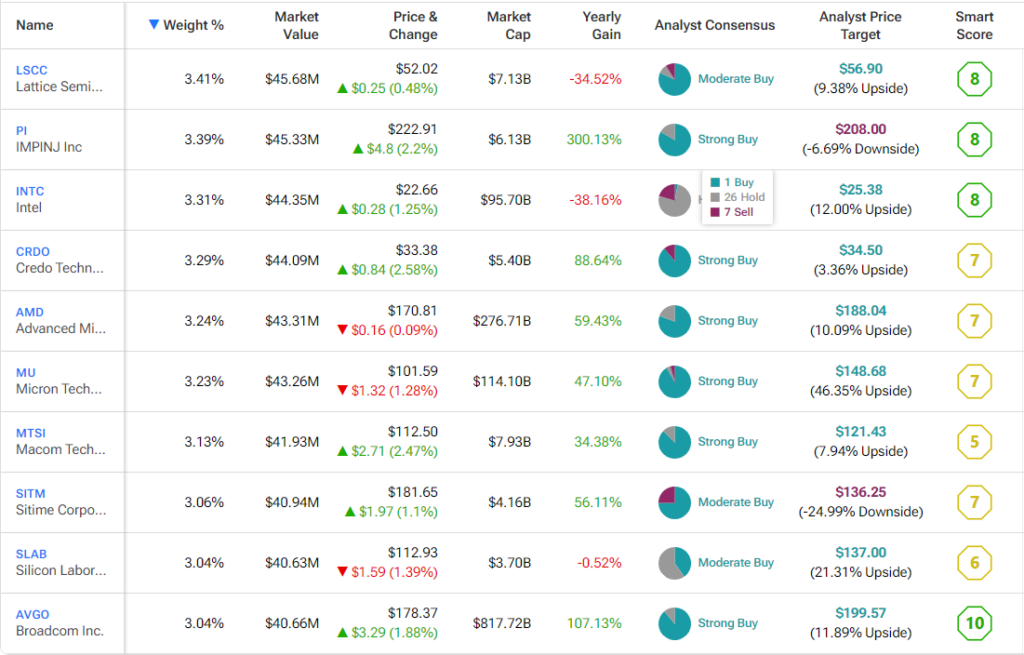

Because it employs this more balanced, equal-weighted approach, XSD is less concentrated than SMH. XSD holds 41 stocks and its top 10 holdings account for just 32.2% of the fund. The below table provides an overview of XSD’s top 10 holdings using TipRank’s holdings tool below.

Unfortunately, this modified equal-weighted index has resulted in lower returns due to much less exposure to booming semi stocks like Nvidia, Broadcom, and Taiwan Semiconductor.

While Nvidia has a weighting of over 20% in SMH, it carries only a 3.0% weighting in XSD and isn’t among the fund’s top 10 holdings (it’s number 20). While XSD has benefited from positions in a few star performers like IMPINJ Inc. (PI), two of the fund’s other top holdings, Intel (INTC) and Lattice Semiconductor (LSCC), are down significantly over the past year despite a strong environment for semiconductors, weighing down the overall fund.

This difference in ETF composition means that while XSD has been a decent performer over time, it hasn’t been able to keep pace with SMH. As of September 30, XSD has generated an annualized return of just 7.1% over the past three years, versus a far better 25.3% for SMH. XSD’s five-year annualized return of 22.1% is a lot better, but still trails SMH’s 33.9% annualized return over the same time horizon.

XSD’s expense ratio of 0.35% is identical to that of SMH.

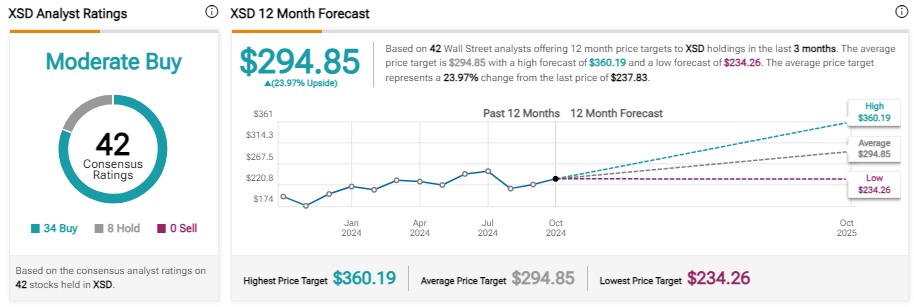

Is XSD Stock a Buy, According to Analysts?

Turning to Wall Street, XSD earns a Moderate Buy consensus rating based on 34 Buy ratings, eight Hold ratings, and zero Sell ratings assigned in the past three months. The average XSD stock price target of $294.85 implies nearly 25% potential upside from recent trading levels.

Overall, I view XSD as a solid ETF, and I’m directionally bullish on the semiconductor industry as a whole. However, its performance has significantly lagged that of SMH in recent times, and I believe that SMH is a stronger pick for investors looking to invest in the semiconductor space.

A Clear-Cut Winner

SMH has been the clear winner in the head-to-head comparison with XSD. While it’s important to remember that past performance is not a guarantee of future results, its exemplary returns have soundly outperformed XSD over various timeframes.

XSD’s performance has been solid, but it has been unable to measure up to the performance of SMH. SMH’s index methodology of favoring the largest semiconductor stocks has been superior to XSD’s modified, equal-weighted approach. XSDs modified equal-weighted approach may be sensible, but it has left it burdened with underperformers like Intel carrying more exposure than market leaders like Nvidia and Broadcom.

I’m bullish on SMH based on its superior, market-beating performance over many years, its concentrated portfolio of market-leading semiconductor stocks, and its reasonable expense ratio. I have a neutral view of the XSD ETF.