Shares of Super Micro Computer (SMCI), Dell Technologies (DELL), and Hewlett Packard Enterprise (HPE) surged about 15%, 4%, and 3%, respectively, on Thursday, following Nvidia’s (NVDA) impressive third-quarter earnings report. NVDA’s strong performance was fueled by the growing adoption of AI technologies across various industries.

Investors should note that SMCI provides advanced server solutions built to handle Nvidia’s high-performance computing (HPC) and AI accelerators. Further, DELL and HPE provide servers and storage solutions to support NVDA’s demanding workloads. Also, both companies offer advanced cooling and power solutions to ensure the optimal performance of Nvidia’s data centers.

As key suppliers to Nvidia, the market is optimistic about these companies benefiting from strong demand for AI hardware. Also, as Nvidia ramps up production of its Blackwell chips, the demand for servers and AI infrastructure from SMCI, DELL, and HPE is expected to increase, driving potential revenue growth for these companies.

NVDA’s Q3 Results and Outlook Drive Optimism

Nvidia’s Q3 results exceeded analysts’ expectations, with revenue reaching $35.08 billion and adjusted earnings per share of $0.81, marking increases of 94% and 101.5%, respectively, from the year-ago quarter.

Also, the company provided a strong Q4 outlook, projecting 70% year-over-year revenue growth, reaching nearly $37.5 billion. Nvidia also highlighted the growing adoption of AI in enterprises, expecting AI enterprise revenues in 2024 to more than double from the previous year. This trend is a boon for server manufacturers, as AI workloads require high-performance hardware.

Importantly, the mention of Dell and Super Micro during Nvidia’s earnings call as key suppliers bolstered investor sentiment, especially for SMCI, which has been facing financial reporting challenges.

Citi Analyst Remains Optimistic About AI Demand

Following NVDA’s Q3 results, Citigroup (C) analyst Asiya Merchant expressed optimism about the prospects of enterprise server providers, DELL, SMCI, and HPE. The analyst believes that Nvidia’s strong performance and the growing demand for enterprise AI solutions will benefit these companies.

What Are the Best AI Stocks?

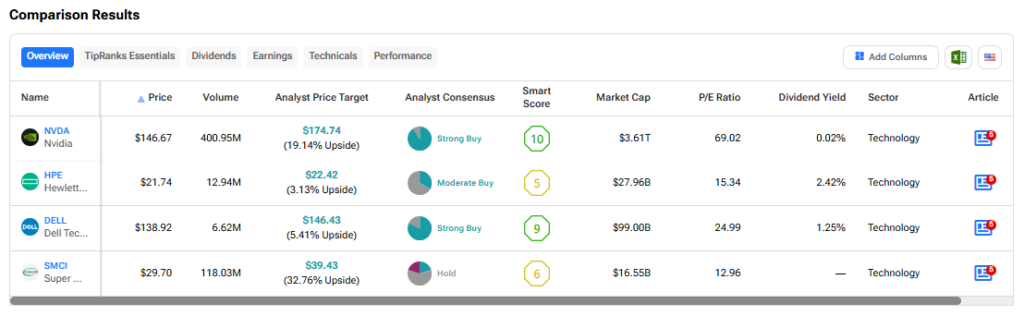

We used TipRanks’ Stock Comparison tool to see which AI stocks rank favorably based on different parameters. As we can see, NVDA and DELL have Strong Buy consensus ratings, while HPE stock is currently rated as Moderate Buy and SMCI as a Hold. Importantly, analysts are predicting solid upside potential in SMCI and NVDA stocks.