Smart Global Holdings forecasted better-than-expected adjusted earnings and net sales in fiscal 3Q after 2Q (ended Feb. 26) results topped consensus estimates. Shares of the electronic products manufacturer increased more than 1% in Tuesday’s extended trading session after closing almost 1.6% lower on the day.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Smart Global’s (SGH) 2Q adjusted earnings jumped 67.3% to $0.87 per share on a year-over-year basis and beat the Street estimates of $0.80 per share. Net sales rose 11.8% to $304 million and outpaced analysts’ expectations of $295.58 million.

The company’s adjusted gross profit surged 12% year-over-year, while adjusted EBITDA was up 38.9%. (See Smart Global stock analysis on TipRanks)

Smart Global CEO Mark Adams said, “The Intelligent Platform Solutions business, formerly referred to as Specialty Compute and Storage Solutions, grew sales 30% quarter over quarter, and when coupled with the newly acquired Cree LED, illustrates the continued progress of a growing and diversified SGH.”

For the third quarter of fiscal 2021, the company projects net sales and adjusted earnings to be in the range of $400-430 million and $1.00-$1.20 per share, respectively. The consensus estimates for revenues and earnings are pegged at $314.01 million and $0.90 per share, respectively.

Following the fiscal 2Q results, Rosenblatt Securities analyst Kevin Cassidy increased the stock’s price target to $70 (43.7% upside potential) from $60 and maintained a Buy rating.

Cassidy said, “SGH continues to be an underappreciated name.”

The analyst recommends “owning the shares ahead of the company’s April 20th Investor Day,” as he expects “this meeting for investors will display the strong product portfolio and quality management team.”

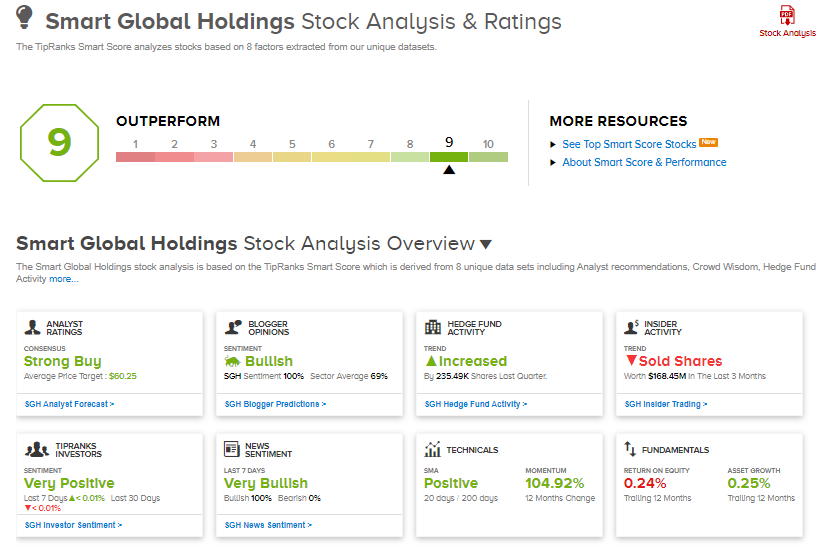

Smart Global shares have exploded 111.2% over the past year, while the stock still scores a Strong Buy consensus rating, based on 4 unanimous Buys. That’s alongside an average analyst price target of $60.25, which implies 23.7% upside potential to current levels.

On top of this, Smart Global scores a 9 out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Pioneer Natural To Buy DoublePoint Energy For $6.4B; Shares Fall Pre-Market

CarMax’s Quarterly Profit Beats Analysts’ Expectations; Shares Tank 7%

Signet Acquires Rocksbox, Expands Services Offerings