Smart Global Holdings has agreed to acquire Cree’s LED business for about $300 million, including fixed upfront and deferred payments and contingent consideration. The deal is expected to close in the first quarter of 2021, the manufacturer and supplier of electronic subsystems said.

According to the agreement, Smart Global (SGH), “will make an initial cash payment of $50 million upon closing and an additional $125 million in a seller-financed note payable interest only until a balloon payment due in August 2023.”

In addition, Cree (CREE) “has the potential to receive an earn-out payment of up to $125 million based on the revenue and gross profit performance of Cree LED in the first full four quarters post-transaction close, payable in the form of a three-year seller note.”

Smart Global’s CEO Mark Adams said “The addition of Cree LED significantly advances our growth and diversification strategy. We see a meaningful opportunity to expand our business into specialty lighting and continue to drive value for our customers, employees, and shareholders.” (See SGH stock analysis on TipRanks)

On Oct. 1, Smart Global reported 4Q revenues of $297 million, compared with analysts’ estimates of $299.4 million. 4Q adjusted EPS of $0.82 beat the Street consensus of $0.78.

Following the company’s 4Q results, Needham analyst Rajvindra Gill raised the price target to $39 (53.7% upside potential) from $35 and maintained a Buy rating. In a note to investors on Oct. 2, Gill said, “We believe SGH stands to benefit from the recovery in the memory cycle and the shift towards high-density, high-margin applications. We view the Brazil business as a reliable source of revenue and view the Specialty Memory and Specialty Compute & Storage Solutions businesses as long-term growth drivers.”

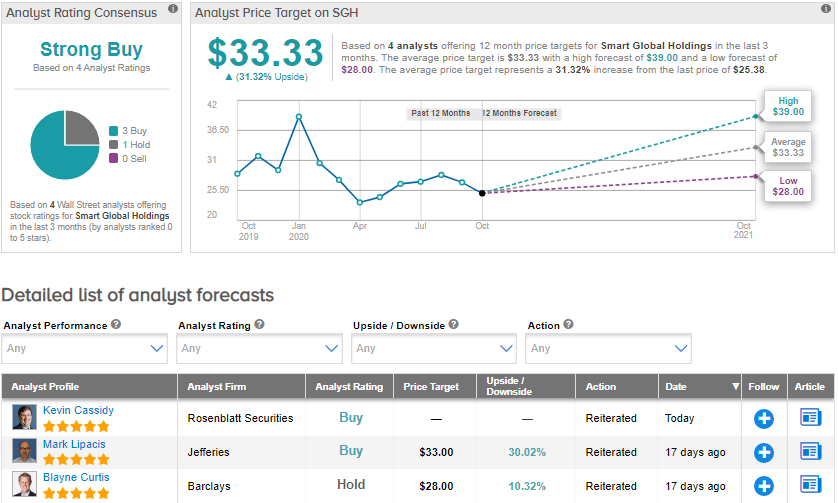

Currently, the Street has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 3 Buys and 1 Hold. With shares down over 33.1% year-to-date, the average price target of $33.33 implies upside potential of about 31.3% to current levels.

Related News:

Smart Global Drops 12% On 4Q Sales Miss

Visa Nabs Strategic Stake In UK Fintech Company GPS

Atlassian Pops 9% On Accelerated Cloud Shift; Analyst Says Buy

Questions or Comments about the article? Write to editor@tipranks.com