Artificial Intelligence (AI) has been a hot topic with its promising capabilities. However, quantum computing, with its potential to surpass the capabilities of AI, is the next high-promise technology that could revolutionize computing. A recent McKinsey report estimated quantum computing may create nearly $2 trillion in value across sectors by 2035. Among the companies pursuing quantum computing, IonQ (IONQ) stands out as a leader in the field of advanced computation technology.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company recently posted top-and-bottom-line results that met and exceeded expectations, and management has revised guidance for the rest of the year. The stock has climbed roughly 8% in the past few days. The stock may be an appealing option for tech-centric long-term investors; however, patience will be critical, as this industry is still in its early stages.

IonQ’s Technological Breakthroughs Winning Clients

IonQ is a leading player in designing, developing, and maintaining quantum computing systems and offering access to quantum computers of varied qubit capacities. These computers are made available through different cloud platforms, including Amazon Web Services (AWS), Microsoft’s Azure Quantum (MSFT), Google’s Cloud Marketplace (GOOGL), and IonQ’s cloud service. The company also provides consultation services for the co-development of algorithms on quantum computing systems.

IonQ is currently making strides in improving the accuracy and fidelity of its quantum computers. Recently, the company has achieved a 2-qubit native gate fidelity of 99.9% (or “three 9’s”).

Furthermore, the company has announced a new industry-first partial error correction technique for an important class of quantum gates. This new technique aims to improve the accuracy of near-term quantum computers, thus propelling the company closer to commercial advantage. The company plans to implement this feature in its IonQ Tempo systems. It expects these hardware and software improvements will aid in extending its three 9s achievement to production systems by 2025 and increasing it to five 9s in 2025 and six 9s in 2026 using error correction.

The Applied Research Laboratory for Intelligence and Security (ARLIS) recently selected the company to design a first-of-its-kind, networked system for blind quantum computing. The company also extended its access contract with Amazon Web Services (AWS), enabling AWS users to leverage IonQ’s quantum computers via Amazon Braket.

IonQ’s Recent Financial Results & Outlook

The company recently announced financial results for Q2 2024 that surpassed expectations. Reported revenue was $11.38 million, beating analysts’ forecasts of $8.66 million and representing an impressive 106% growth compared to the same period of the previous year. Operating costs and expenses increased by 56% year-over-year to $60.3 million. This rise is attributed to increased research and development, sales and marketing, and general and administrative costs.

Despite these increased expenses, IonQ reported a reduced net loss of $37.6 million compared to $43.7 million in the same period of the previous year. Adjusted EBITDA loss was $23.7 million, with earnings per share EPS of -$0.18, exceeding consensus estimates of -$0.22.

The company’s cash, cash equivalents, and investments totaled $402.0 million at the quarter’s end. IONQ has indicated that, having recently completed the first quantum computing manufacturing facility in the U.S., most manufacturing investment is now completed, and it plans a conservative spending strategy while focusing on large sales deals.

Management has revised its financial outlook for 2024, raising its revenue guidance to between $38 million and $42 million, with an expected third-quarter revenue of $9 million to $12 million. The management team remains confident in its 2024 bookings guidance of between $75 million and $95 million.

What Is the Price Target for IONQ Stock?

The stock has been highly volatile, with a beta of 2.81, and has been on a downward trend for much of the past year, shedding 54%. It trades at the low end of its 52-week price range of $6.33 – $21.60 and shows negative price momentum, trading below its 20-day (7.84) and 50-day (7.91) moving averages. The P/B ratio of 3.29x is slightly below the Computer Hardware industry average of 3.57x.

Turning our heads to Wall St. analysts following the company, we see a cautiously optimistic view of the stock. For instance, Craig-Hallum analyst Richard Shannon recently lowered the price target on the shares from $21 to $15 while maintaining a Buy rating, noting that IonQ’s announcements about gate fidelities and error correction are among the most important metrics to track for any QC modalities.

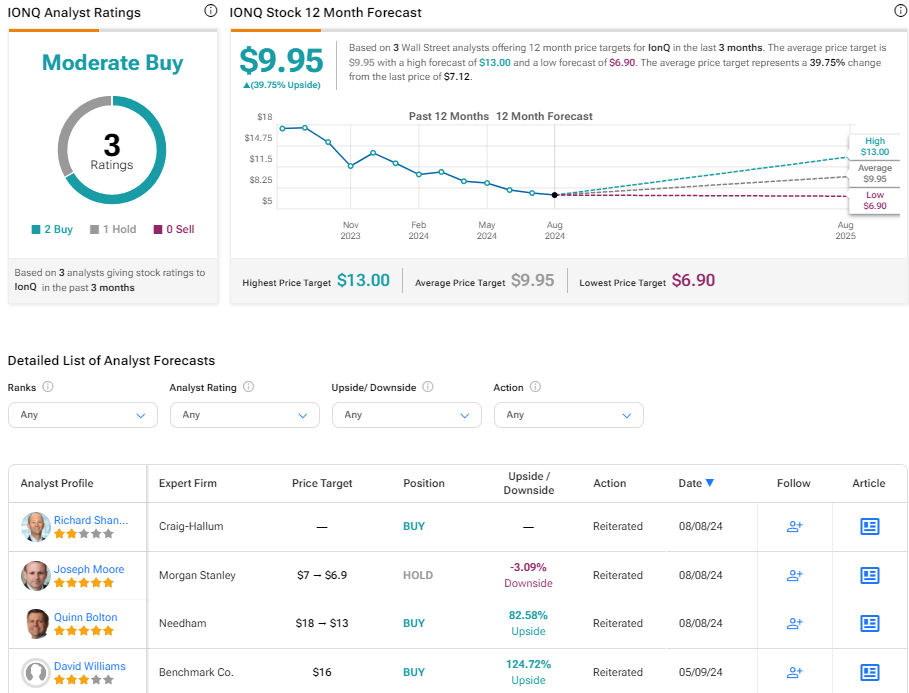

Based on the recommendations and price targets recently issued by five analysts, IonQ is rated a Moderate Buy. The average price target for IONQ stock is $9.95, representing a potential 39.75% upside from current levels.

Bottom Line on IonQ

IonQ has demonstrated impressive growth and innovation. The company’s quantum computers’ advancements in accuracy and fidelity and significant error correction strides are promising. Its collaborations with prestigious platforms such as Amazon Web Services and Microsoft’s Azure Quantum and growing revenues paint a positive picture.

Though patience is required as the quantum industry matures, IonQ’s burgeoning growth, consistent technological advancements, and strategic partnerships position the firm as an attractive investment opportunity for tech-forward, long-term investors.