Shares in Slack Technologies (WORK) plunged 15% in Thursday’s after-hours trading after the company reported a solid F1Q21 but withdrew full year billings guidance. Slack also revealed an exciting new strategic collaboration with Amazon (AMZN)- but that wasn’t enough to send shares higher.

Revenue, billings, margin, and FCF were ahead of consensus with Q1 Non-GAAP EPS of -$0.02 beating Street expectations by $0.04. Similarly GAAP EPS of -$0.13 beat by $0.04 and revenue of $201.7M delivered strong year-over-year growth of 50%, while topping expectations by $13.58M.

Meanwhile calculated billings came in at $206M vs consensus of $189.2M, and representing 38% year-over-year growth.

F2Q guidance came in higher than consensus as well, and FY21 was raised on revenue, FCF and margin. Calculated billings guidance was withdrawn due to the ongoing uncertainties surrounding the COVID-19 pandemic, but the consensus had been for guidance of $1.000.9B (+30.8% Y/Y).

“Q1 was a phenomenal quarter for Slack, with the addition of 12,000 net new Paid Customers and 50% revenue growth year-over-year,” said Stewart Butterfield, CEO and Co-Founder at Slack.

“We believe the long-term impact the three months and counting of working from home will have on the way we work is of generational magnitude. This will continue to catalyze adoption for the new category of channel-based messaging platforms we created and for which we are still the only enterprise-grade offering” he added.

At the same time Slack and Amazon announced a new multi-year agreement to deliver solutions for enterprise workforce collaboration.

Development teams will now be able to communicate and manage their AWS resources from inside Slack. Slack will migrate its Slack Calls capability for voice and video calls to Amazon Chime, AWS’s communications service, and use AWS’s global infrastructure.

“Together, AWS and Slack are giving developer teams the ability to collaborate and innovate faster on the front end with applications, while giving them the ability to efficiently manage their backend cloud infrastructure,” said Andy Jassy, CEO of AWS.

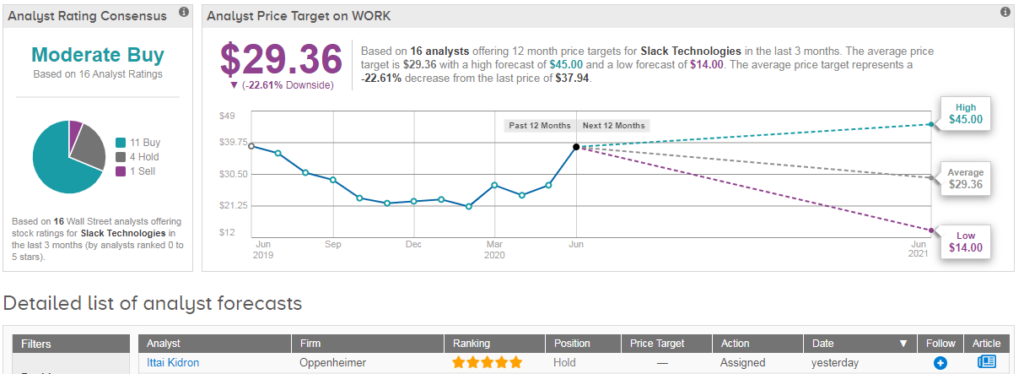

Notably shares in Slack have already rallied a whopping 68% year-to-date, and as a result the stock scores a cautiously optimistic Moderate Buy consensus from the Street. Meanwhile the average analyst price target stands at $29 (23% downside potential). (See WORK stock analysis on TipRanks).

“On the whole, we see a balanced view given multiple LT growth levers (new customers/users, international expansion, etc.) offset by potential second-derivative macro pressure points. Maintain perform, viewing Slack as fairly valued at ~18x EV/sales on our FY22 estimates” explained Oppenheimer’s Ittai Kidron following the earnings report.

Related News:

Nio Rising On Record-High Monthly Deliveries, Goldman Sachs Upgrade

Ebay Lifts Quarterly Sales and Profit Forecast; Shares Jump To All-Time High

Microsoft Buys Metaswitch For Cloud-Based Telecoms Move, 5G Expansion