Shares of auto entertainment solutions provider SiriusXM (NASDAQ:SIRI) are in focus today after it received a non-binding proposal from Liberty Media Corp. (NASDAQ:LSXMA) for a potential transaction.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The potential transaction involves the separation of assets and liabilities attributed to the Liberty SiriusXM tracking stock group (LSXM) from Liberty Media via a split-off of a new company. This new company will be combined with SiriusXM, which will result in the investors of Liberty SiriusXM tracking stock and SiriusXM common stock holding one class of common shares of the combined entity.

Now, SIRI’s special committee of independent directors of its Board and its advisors are evaluating the proposal. The company noted that there is no assurance of a transaction being completed.

According to the proposal, the minority investors in SIRI would own 16% of the combined company, while the former holders of LSXM stock would own nearly 84% of the combined company.

The proposal is aimed at rationalizing the dual corporate structure between LSXM and SIRI. The development has sent LSXMA shares nearly 7.5% higher today. After an initial decline, SIRI shares, too, are trending marginally higher.

What is the Future of SIRI Stock?

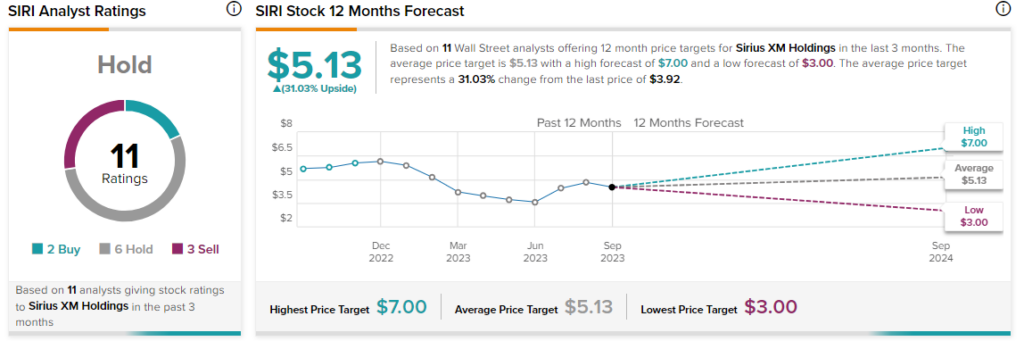

Overall, the Street has a consensus price target of $5.13 on SIRI, alongside a Hold consensus rating. This implies a 31% potential upside in the stock.

Read full Disclosure