Shares of audio entertainment company SiriusXM (NASDAQ:SIRI) are marching higher today after its third-quarter EPS of $0.09 came in better than estimates by $0.01. Revenue of $2.27 billion, on the other hand, missed the cut by $20 million.

Impressively, the company’s bottom line rose by 47% year-over-year to $363 million. During the quarter, while its self-pay subscribers declined by 96,000, the number of paid promotional subscribers rose by 2,000, bringing the total number of subscribers to 34 million. The average revenue per user (ARPU), though, remained essentially flat at $15.69.

SiriusXM is actively adding exclusive content through celebrity partnerships and remains focused on offering a differentiated content portfolio in the audio marketplace. Moreover, automaker Ford (NYSE:F) plans to integrate SiriusXM as a standard feature in its F-150 model.

For Fiscal year 2023, SIRI expects to generate total revenue of $9 billion and $2.75 billion of adjusted EBITDA. Importantly, the company is expected to unveil its next-generation SiriusXM platform on November 8, a key event to keep an eye on.

Is SIRI a Good Stock to Buy?

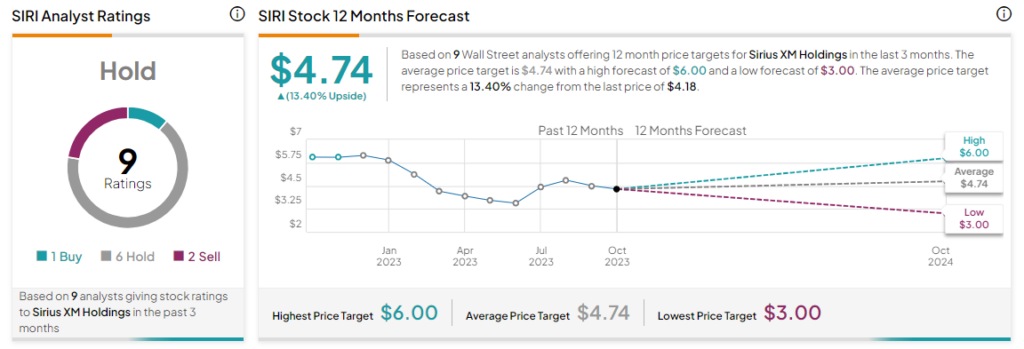

Overall, the Street has a Hold consensus rating on SiriusXM. The average SIRI price target of $4.74 implies a modest 13.4% potential upside. That’s after a nearly 10.6% rise in SIRI shares over the past six months.

Read full Disclosure