The world’s largest retailer of diamond jewelry Signet Jewelers Limited (SIG) delivered outstanding second-quarter results driven by an overall increase in the average transaction value and growth in the number of transactions. Shares popped 5.6% on the news, closing at $85.26 on September 2.

Signet reported earnings of $3.57 per share, significantly higher than the Street’s estimate of $1.62 per share. In Q2 FY21, the company posted a loss of $1.13 per share. (See Signet Jewelers stock charts on TipRanks)

Moreover, total sales more than doubled to $1.79 billion compared to the year-ago period and outpaced analysts’ estimates of $1.63 billion. Also, same-store sales (SSS) grew 97.4% year-over-year, alongside 24.5% growth in eCommerce sales and Brick and mortar SSS growth of 130.8%.

Commenting on the quarterly results, Signet CEO, Virginia C. Drosos, said, “Our Signet team delivered strong second-quarter top and bottom-line performance with continued execution of our Inspiring Brilliance strategy, enabling us to maximize jewelry category strength and capture share over the last year… Our performance this quarter demonstrates that our banner value propositions, product newness, always-on marketing, and connected commerce experiences are resonating with new and loyal customers.”

Based on its business strength and confidence in its growth strategy, Signet raised its full fiscal year 2022 guidance. However, the company maintains caution about the ongoing pandemic and supply chain disruptions.

For FY22, the company now forecasts revenue to be in the range of $6.80 – $6.95 billion compared to the consensus estimate of $6.71 billion. Also, third-quarter revenue is projected to be in the range of $1.26 – $1.31 billion.

Impressed by Signet’s “very strong” Q2 beat and raise performance, Wells Fargo analyst Ike Boruchow lifted the price target on the stock to $80 (6.2% downside potential) from $70 while maintaining a Hold rating.

Additionally, Boruchow said that there are few holes to poke in the print and the guidance appears “very conservative”. Also, the planned increase in the company’s stock repurchase program to $225 million from $166 million gives more confidence to its business growth trajectory.

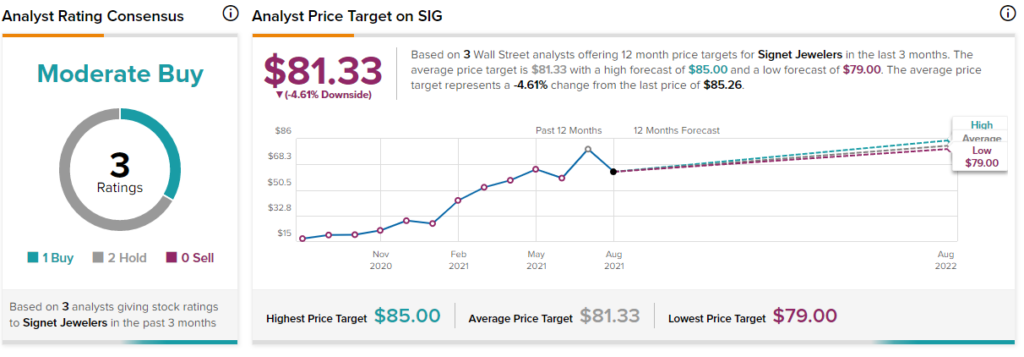

Overall, the stock has a Moderate Buy consensus rating based on 1 Buy and 2 Holds. The average Signet Jewelers price target of $81.33 implies 4.6% downside potential to current levels. Shares have exploded 377% over the past year.

Related News:

Chewy Slips 10% After-Hours on Q2 Miss

Five Below Falls 9% After-Hours on Mixed Q2 Results

Okta Slips 3% After Hours Despite Exceeding Q2 Expectations