Shares of buy now, pay later (BNPL) consumer lending company Affirm (NASDAQ:AFRM) soared 17% over the past two trading sessions following positive news of a new relationship with Apple (NASDAQ:AAPL). The company announced that its BNPL service will soon integrate with Apple Pay, such that shoppers either online or in-app will be able to pay for their purchases on credit, over time, when checking out with Apple Pay.

Commenting on the news, Barclays analyst Ramsey El-Assal noted that Affirm will become Apple Pay’s only BNPL option. Affirm, however, will not be exclusively patronizing Apple, and will be free to extend its services to other checkout providers – a plus from Affirm’s perspective. And a second plus is that Apple users will not need to possess an Affirm Card in order to use the company’s BNPL services on Apple Pay, extending Affirm’s potential reach via Apple.

El-Assal noted that it’s his understanding the relationship will begin with the Apple’s iOS 17 rollout in September 2024.

And yet, Affirm says its partnership won’t have any “material impact on revenue or gross merchandise volume in fiscal year 2025.”

That doesn’t sound like particularly big news, and yet the stock jumped 17%. Why?

Even if Affirm sees little short or even medium term benefit to its finances from this tie-up, El-Assal says the partnership is at least “incrementally positive” for Affirm. And over the longer term, the analyst predicts that this partnership has “the potential to eventually expand into other geographies, offline transactions, or other consumer finance offerings.”

Still, that all sounds speculative, and not necessarily a great reason to buy unprofitable Affirm stock, which has lost money every year it’s been in existence, including more than $472 million lost in the first three quarters of 2024.

Adding color to the picture, though, is a separate note from BTIG analyst Andrew Harte, who agreed with El-Assal that he’s “incrementally more positive on AFRM after the Apple Pay announcement.” He’s not positive enough to join his colleague in recommending the stock, and is instead sticking with his Neutral rating on Affirm. Still, if there’s good news for investors in Harte’s note, it’s that he isn’t quite as worried about Affirm’s disclaimer of any hope of growing its revenue through partnering with Apple.

“To us this is a statement more about Affirm declining to provide guidance on the 2025 impact, rather than a statement about the mature market opportunity of the Apple partnership,” opined Harte.

Better for investors if Affirm management underpromises now, and overdelivers in 2025 or beyond. If that’s the way things play out, the profits will be all the sweeter for management’s conservatism today.

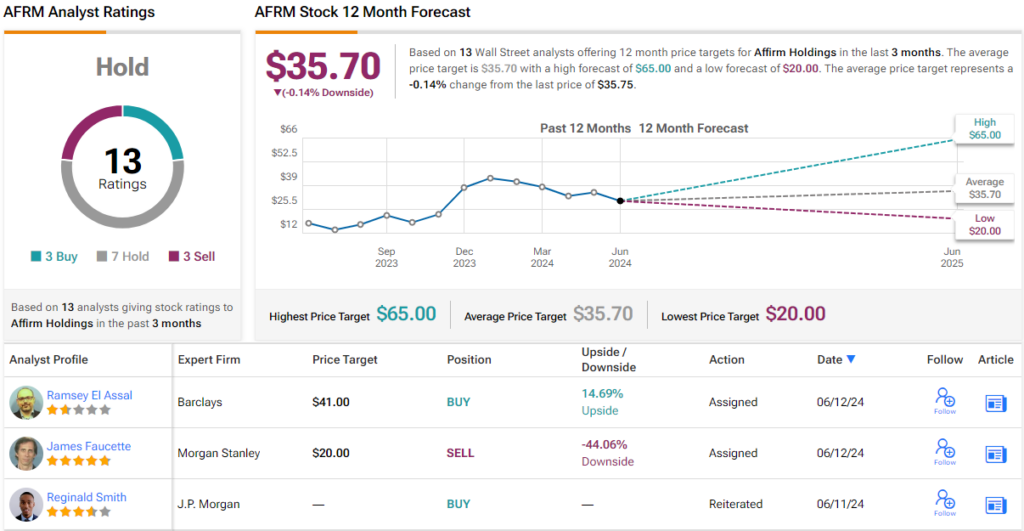

All in all, Affirm’s prospects don’t appear too favorable amongst Wall Street’s analyst corps right now. Based on 7 Holds, and 3 Buys and Sells, each, the stock makes do with a Hold (i.e. Neutral) consensus rating. Priced at $35.75, shares appear fully valued, as the current $35.70 average price target indicates. (See AFRM stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.