Looking to add some promising stocks to your portfolio but confused about what to look for or how to start? Investors need not worry as TipRanks’ Stock Screener Tool comes to your aid.

Investing in the most happening sector of the stock market–technology– seems to be a wise choice now amid several uncertainties prevailing in the market, including inflation and the Ukraine-Russia war, among others. One such tech stock with upside potential is DigitalOcean Holdings, Inc. (DOCN).

New York-based, DigitalOcean is a cloud computing platform that offers on-demand infrastructure and platform tools for various clients, including developers, start-ups, and small and medium-sized businesses. Shares of the company have surged 22% in the past year.

Now, let’s see the screening factors which currently make DigitalOcean a top stock.

The Street seems to be bullish on the stock, as reflected by a Strong Buy consensus rating based on eight Buys and two Holds. DigitalOcean’s average price forecast of $76.30 implies an upside potential of 41.8% from current levels.

Recently, Piper Sandler analyst James Fish reiterated a Buy rating on DigitalOcean with a price target of $72 (33.8% upside).

James Fish is of the opinion that the company may drive benefit from the shift of the 18% public cloud workload annual growth, of which cloud spending is only 23% of broader infrastructure spending at present.

Another major factor that shows potential in DOCN is its Perfect Smart Score, which is a data-driven score that evaluates a stock based on eight key market factors. The Top Smart Score stocks with a “Perfect 10” score have significantly outperformed the S&P 500 in the past years.

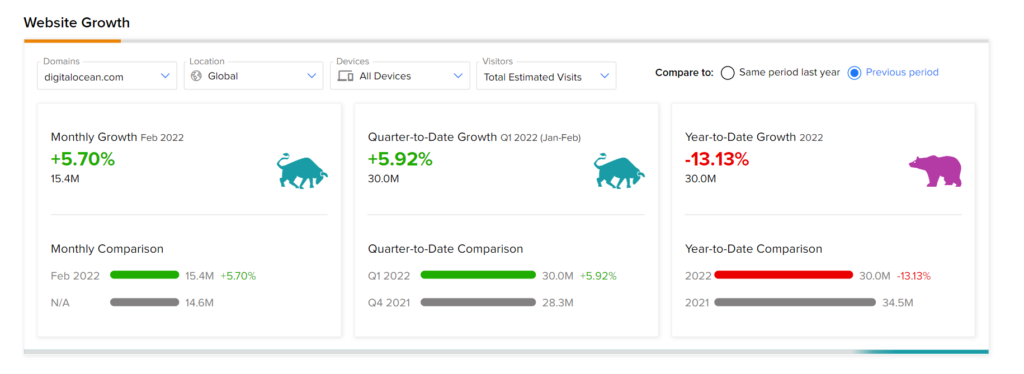

Meanwhile, in the last quarter, hedge funds bought 198,300 shares of DigitalOcean, while corporate insiders increased exposure to the stock by $534,900 in the last three months. Further, as per DOCN’s website traffic analytics for the month of February, global visits have improved by 5.7% against the same period last year.

Conclusion

Thus, all the above factors point toward rising confidence for investors and insiders in the stock’s performance in the near term.

Further, the company has announced that it will release its Q1 results on May 4, 2022. The Street’s expectations are well within the guidance provided by the company, indicating a possible beat this time around as well.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Can Increased Buyback Plan Lift Capital One’s Shares?

Why is SoFi Falling in Pre-Market Trading?

Bed Bath & Beyond Boards Kroger’s Ship