The pandemic has crushed several businesses but e-commerce is definitely not one of them—in fact, the shift to e-commerce has accelerated as COVID led to a temporary closure of retail stores. As per Digital Commerce 360, online spending increased 30.1% Y/Y to $347.26 billion in the first half of this year.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Even after the easing of lockdown restrictions, e-commerce continues to be strong, though the growth rate has decelerated. According to Adobe Analytics, e-commerce sales grew 55% Y/Y to $66.3 billion in July, compared to a growth of 76% in June.

We will use the TipRanks’ Stock Comparison tool to compare Shopify and Etsy and see which e-commerce stock offers better growth potential to investors.

Shopify (SHOP)

Canada-based Shopify provides entrepreneurs and merchants, whether big or small, an online platform to sell their goods. It also helps them scale their businesses and provides other support services like payment processing and shipping and logistics services.

Thanks to pandemic-led demand, Shopify had a stellar second quarter with revenue rising 97% Y/Y to $714.3 million. New stores created on Shopify grew 71%, reflecting the rapid shift to e-commerce amid the pandemic and also the impact of the company’s free trial offer that ended on May 31. The company posted adjusted EPS of $1.05, up from $0.10 in the 2019’ second quarter.

Gross Merchandise Volume or GMV surged 119% in the second quarter. However, the company cautioned that the growth was decelerating in June and July as retail stores started reopening.

Since the pandemic, Shopify has seen huge demand in the food, beverages and tobacco categories. Big names like Heinz and Lindt subscribed to the premium subscription plan Shopify Plus to leverage the demand in online channels.

Shopify is ramping up its investment in its Shopify Fulfillment Network solution that will help merchants deliver their goods faster and efficiently to the buyer. Last year, the company acquired 6 River Systems, a cloud-based software and robotics provider, to strengthen its fulfillment solution.

What’s more, the company has also inked strategic deals with the likes of Facebook, Walmart, and Pinterest to widen its reach. Through the recently announced deal with Walmart, 1,200 Shopify merchants will able to sell their goods to a large customer base through the Walmart marketplace.

On August 26, Atlantic Equities analyst Kunaal Malde initiated coverage of Shopify with a Buy rating and a price target of $1150. He believes, “Shopify is also significantly undermonetized, with product extensions, such as fulfillment, providing a significant upside opportunity.”

The analyst added, “The stock’s valuation is the key hurdle, but the total addressable market is vast, there are increasing benefits to scale, and e-commerce acceleration has sustained as economies reopened.” (See SHOP stock analysis on TipRanks)

The 12-month average analyst price target of $1111.67 is quite below Kunaal’s estimate and indicates an upside potential of 9.5% in Shopify stock, which has already risen a staggering 156% year-to-date. Overall, 10 Buys, 14 Holds, and 1 Sell add up to cautiously optimistic Moderate Buy consensus.

Etsy (ETSY)

Etsy connects small businesses and artisans with prospective buyers through its e-commerce platform. The company saw a huge spike in its business since the novel coronavirus outbreak. The sales of masks fetched the online marketplace gross merchandise sales or GMS of $346 million in the second quarter. And non-mask GMS surged 93% as people bought homewares and home furnishings as well as craft supplies.

Overall, Etsy’s second-quarter revenue grew 137% year-over-year to $429 million. GMS rose 146% to $2.7 billion. The online platform saw a 34.6% rise in active sellers to 3.14 million while active buyers grew 41.0% to 60.3 million. Strong sales triggered a 436% jump in EPS to $0.75.

Etsy is investing in marketing to draw more customers. It continues to invest in technology to enhance its platform and make it convenient and attractive for the buyers and sellers. For instance, the company added banners on listing pages to offer other options that match a buyer’s search criteria across shops. Currently, Etsy offers its payments solution in 43 countries in 19 currencies and intends to expand it further.

Plus the company strengthened its business through the 2019 acquisition of Reverb Holdings, a marketplace for new, used and vintage music.

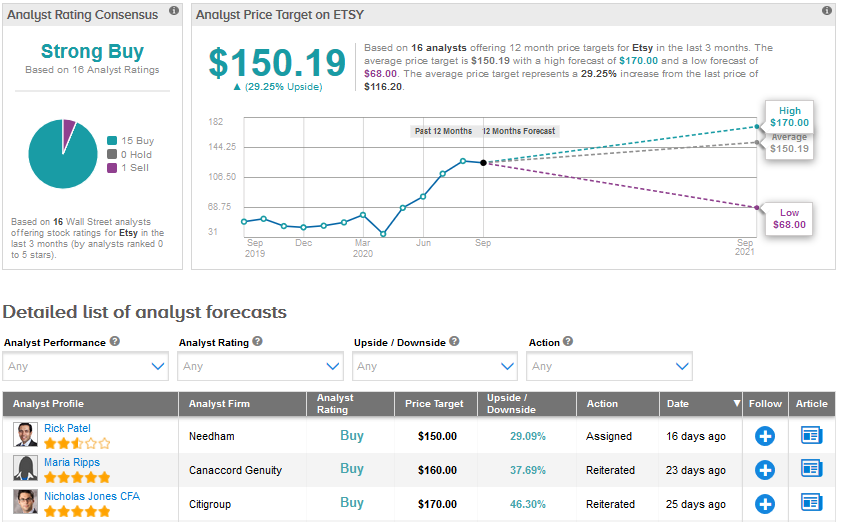

Following a meeting with Etsy’s management, Needham analyst Rick Patel stated, “We have and continue to believe in the merits and LT opportunity around Offsite Ads, which we see as a win/win for Etsy and its sellers as it increases visibility for the platform while driving economic accretion. The biggest hurdle we see is tough comparisons shaping up in 2021, which we see as a high-quality challenge to have.”

He believes, “it’s important to take a LT [long-term] view as Etsy widens its TAM [total addressable market] and buyer base, and we expect the company to remain one of the highest-quality growth stories in digital commerce.” (See ETSY stock analysis on TipRanks)

The Street mirrors Patel’s optimism with a Strong Buy consensus for the e-commerce platform. The stock has surged 162% so far in 2020 and is expected to advance 29.3% over the next 12 months as indicated by the average analyst price target of $150.19.

Conclusion

Most analysts and investors are optimistic about the long-term growth potential of Shopify based on its huge addressable market. However, the company’s premium valuation has been a matter of debate and many believe that the expected growth is already priced in the stock. Right now, the consensus Strong Buy rating and upside potential reflect that the Street is more in favor of Etsy.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment