Shopify (TSE: SHOP) (NYSE: SHOP) will announce its 2021 fourth-quarter results on February 16 before the opening bell.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Shares of the e-commerce platform have plunged by 37.4% year-to-date. The is currently trading at over C$1,102 per share. Solid results could push the stock higher, so let’s have a look at what analysts are expecting.

Analysts Estimates

The Zack Consensus Estimates for earnings is $1.33 per share, which represents a decrease of 15.8% from the prior-year quarter.

The estimate for revenue is $1.34 billion, indicating a growth of 37.4% from the fourth quarter of 2020.

Points to Watch

Management said the fourth-quarter period would likely be strong even if Shopify adds fewer merchants compared to the record result at the end of 2020. Shopify is expected to reach around $1.7 billion in sales, according to Wall Street analysts, which would result in a more than 70% increase.

Management warned of several near-term pressures on cash flow and profitability, including that growing platform engagement is down from 2020. Rising costs and challenges of the supply chain don’t help either.

Shopify is expected to report impressive gross profitability, slightly offset by increased spending on the platform. Adjusted operating income reached 18% of sales in the first nine months of 2021, compared to 12% a year earlier. However, the growth rate slowed sharply in the third quarter and may slow further in the coming quarters.

Wall Street’s Take

On February 11, Wedbush analyst Ygal Arounian kept a Buy rating on SHOP and lowered the price target to $1,270 (C$16,617.88). This implies 46.8% upside potential.

Arounian expects Shopify to report strong Q4 results, with more robust growth early in the quarter offsetting the overall slowdown in BFCM and spending in December.

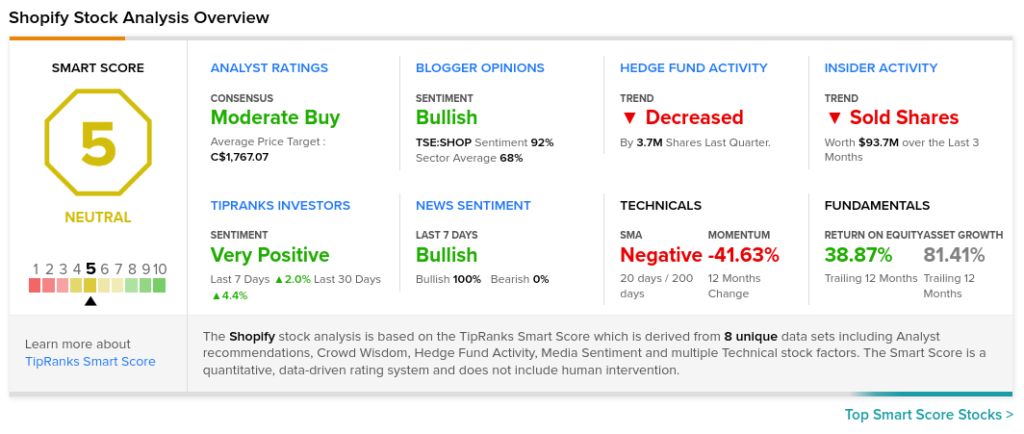

The rest of the Street is cautiously optimistic about SHOP with a Moderate Buy consensus rating based on 13 Buys and 10 Holds. The average Shopify price target of C$1,767.07 implies upside potential of about 60.3% to current levels.

TipRanks’ Smart Score

SHOP scores a 5 out of 10 on the TipRanks Smart Score rating system, indicating that the stock should perform in line with the overall market.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Related News:

Thomson Reuters Swings to Loss in Q4

OpenText Swings to Profit in Q2, Raises Guidance

Lightspeed Fiscal Q3 Revenue Rises 165%, Loss Widens