Global energy demands are surging, driving the solar market to grow at a forecasted 16% annual rate, reaching a valuation of $837.3 billion by 2032. Shoals Technologies (SHLS), a pioneering provider of electrical balance of systems (EBOS) for the solar, energy storage, and EV industries, is poised to leverage this growth opportunity. Although the stock has been down 60% this year, recent positive news regarding a ruling from the U.S. International Trade Commission (ITC) in a patent infringement case has sparked a 15% rally in the share price.

The company represents an intriguing prospect for investors interested in exposure to the burgeoning solar and EV sectors.

Shoals Offers Critical Solar Components

Shoals is a technology company at the forefront of electrical balance of system (EBOS) solutions for solar energy projects across the United States. The EBOS is integral to solar energy systems as it consists of all necessary components transmitting the electric current generated from solar panels through an inverter and eventually to the power grid.

The company has received a favorable preliminary ruling from the U.S. International Trade Commission (ITC) in a patent infringement case against Voltage, LLC. According to the ruling, Voltage has breached Section 337 of the Tariff Act of 1930 by importing products that infringed Shoals’ patent rights.

In addition, Shoals has recently been granted two more patents on its BLA technology. If the Commission upholds this ruling, it will inhibit the illegal import of photovoltaic connectors that violate Shoals’ intellectual property, further protecting Shoals’ patented Big Lead Assembly (BLA) connectors, which provide cost and maintenance advantages in the solar panel array industry.

Shoals’ Recent Financial Results & Outlook

The company recently reported results for the second quarter of 2024. Despite a 16.8% year-on-year decline, revenue of $99.2 million slightly beat analysts’ expectations by $8.67 million. This reduction can be attributed to lower sales volumes caused by project postponements. Gross profit stood at $40.0 million, a decrease from the previous year’s $50.5 million, due to increased labor costs and diminished fixed-cost leverage.

Also, General and administrative expenses rose to $19.2 million due to payroll increases and legal fees. Income from operations was $18.6 million, while net income was $11.8 million. Adjusted EBITDA reduced to $27.7 million, contributing to the adjusted net income decline to $17.8 million. However, non-GAAP earnings per share (EPS) of $0.10 surpassed consensus predictions by $0.02.

As of the quarter’s end, the company reported a backlog and awarded orders worth $642.3 million, a 4% sequential increase from the end of the first quarter and an 18% year-over-year growth. This surge can be attributed to success with new customers, upcoming projects in 2025, and expansive growth in international markets, which now make up more than 12% of the total backlog and awarded orders.

Following second-quarter results, SHLS’ management has issued guidance. For the third quarter of 2024, the company anticipates instability in the utility-scale solar market and forecasts revenues between $95 and $105 million with an adjusted EBITDA between $25 and $30 million. For 2024, the company expects to generate revenue between $370 and $400 million, adjusted EBITDA from $96 to $110 million, and adjusted net income between $62 and $76 million.

What Is the Price Target for SHLS Stock?

The stock has been on a volatile downward trajectory, sporting a beta of 1.93 as it declined over 83% in the past three years. It trades at the low end of its 52-week price range of $5.69 – $28.34, though the recent positive price momentum has it trending toward exceeding its 20-day and 50-day moving averages.

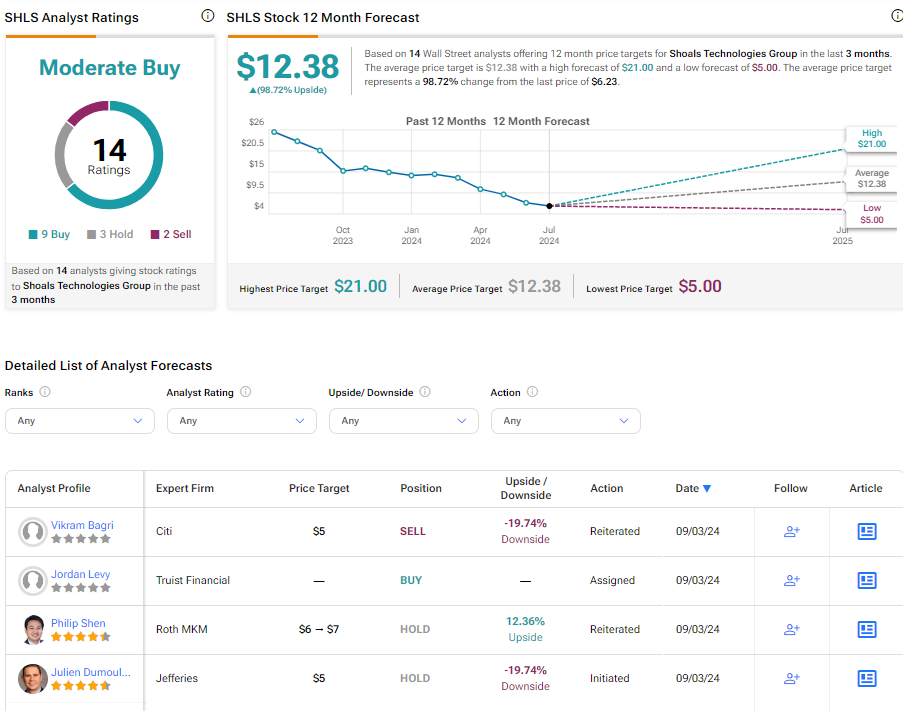

Analysts following the company have been constructive on SHLS stock. For instance, Jefferies analyst Julien Dumoulin Smith recently initiated coverage of Shoals Technologies, assigning a Hold rating and a $5 price target. He noted the company is a preferred partner for leading solar and storage companies, though it faces a challenging core utility-scale solar industry.

Shoals Technologies Group is rated a Moderate Buy based on the cumulative recommendations and price targets of 14 analysts. The average price target for SHLS stock is $12.38, representing a potential 98.72% upside from current levels.

Shoals in Summary

As the global energy sector shifts towards sustainable solutions, Shoals Technologies is poised to leverage growth opportunities in the ever-expanding solar market. Although the stock has experienced a decline this year, its recent rally points to further potential upside. Shoals has promising prospects, with an impressive backlog and awarded orders indicating a robust demand for its products. With its unique positioning and promising outlook, SHLS presents a compelling investment opportunity for those looking to tap into the flourishing solar and EV sectors.