Energy giant Shell (SHEL) (GB:SHEL) is planning to lay off about 20% of its employees within its oil exploration and development, and subsurface units, according to Reuters. This move aligns with Shell’s CEO Wael Sawan’s broader cost-cutting strategy, which aims to reduce operating expenses by $3 billion by the end of 2025. Importantly, Sawan has already realized $1.7 billion in savings since he took over in 2023.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Prior to the latest job cuts, Shell had laid off employees in its low-carbon solutions, deal-making, chemicals, and offshore wind teams.

Layoffs Hit Exploration and Development Unit

The job cuts will affect geologists, geophysicists, and oil and gas well designers within Shell’s exploration and development unit. Additionally, the company plans to merge technical departments, leading to further job losses.

It is worth mentioning that the exploration and well development unit is part of Shell’s Upstream division, a critical segment that contributed over one-third of the company’s adjusted earnings in 2023, totaling $28.25 billion.

Is SHEL a Buy?

Shell stock is up over 20% in one year. Further, it sports a Strong Buy consensus rating based on five unanimous Buy recommendations. The analysts’ average price target on SHEL stock of $84.30 implies 16.24% upside potential from current levels.

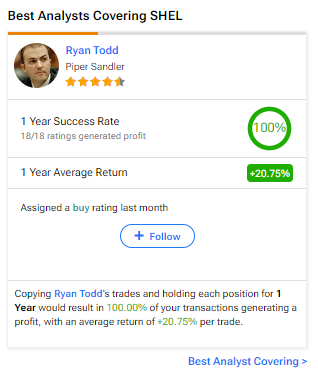

Interestingly, investors considering SHEL stock could follow Piper Sandler analyst Ryan Todd. He is the best analyst covering the stock (in a one-year timeframe). The Top-rated analyst boasts an average return of 20.75% per rating and a 100% success rate. Click on the image below to learn more.