Shaw Communications Inc. (SJR.B) posted higher revenue and profit in its third quarter. These are Shaw’s latest financial results since it agreed to be bought by Rogers Communications for C$26 billion, subject to federal approvals.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Net income came in at C$354 million for the quarter ended May 31, compared to C$184 million in the third quarter of the prior year.

Per diluted share, Shaw earned C$0.70 in Q3 2021, twice that of Q3 2020. Consolidated revenue amounted to C$1.38 billion, an increase of 4.8% from C$1.31 billion in the prior-year quarter. Analysts on average expected Shaw to earn C$0.34 per share on C$1.35 billion in revenue.

Shaw Communications’ Executive Chair and CEO Brad Shaw said, “Following nearly two years of regulatory uncertainty impacting our industry, the recent decisions by the CRTC have restored confidence in the regulatory framework and provided the necessary certainty to make the generational facilities–based investments that are required and critical in support of the latest technologies, strong competition and choice for more Canadians. By Shaw and Rogers coming together, the combined entity will have the scale, assets and capabilities to confidently invest billions of dollars that will serve future generations, help to close the digital divide and deliver coast-to-coast 5G service throughout Canada.”

Shaw added approximately 51,000 new wireless customers, generating 9.2% revenue growth, partially offset by lower average revenue per user. Wireline revenues increased 1.6% to C$1.08 billion. (See Shaw Communications Inc. stock chart on TipRanks)

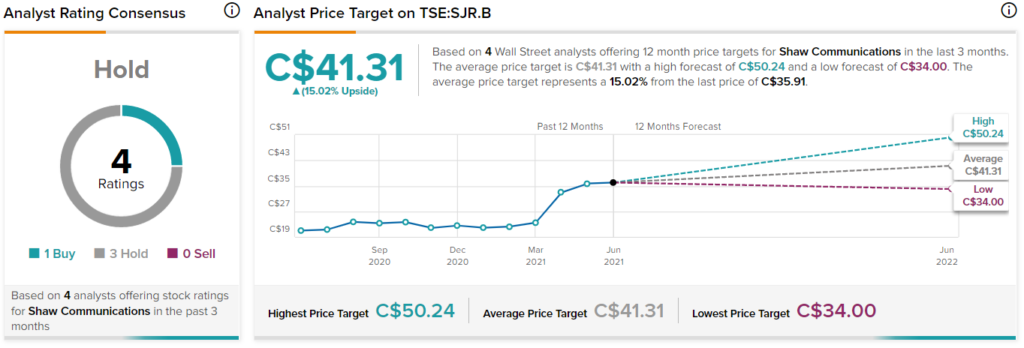

Last month, Morgan Stanley analyst Simon Flannery reiterated a Hold rating on the stock and set his price target at C$34.00. This implies 5.3% downside potential.

Overall, Shaw Communications stock scores a Hold consensus rating by Wall Street analysts based on 1 Buy and 3 Holds. The average Shaw Communications price target of C$41.31 implies upside potential of about 15% to current levels. Shares have gained approximately 60% year-to-date.

Related News:

BlackBerry Q1 Revenue Falls, Beats Estimates

Alithya Loss Narrows in Q4, Sales Hit Record

Lightspeed to Acquire Two E-Commerce Platforms for $925 M; Street Says Buy