Shares of SharpSpring, Inc. (SHSP) popped as much as 20% by the end of trade on June 22, after the company agreed to be acquired by Constant Contact, an online marketing company which is backed by Clearlake Capital Group and Siris Capital. The all-cash transaction of approximately $240 million includes the company’s outstanding debt.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

SharpSpring is a cloud-based lead generation and marketing automation platform. It helps small businesses (SMBs) generate leads, improve conversions to sales, and drive revenue growth at affordable prices. (See SharpSpring stock chart on TipRanks)

Constant Contact will buy all of the outstanding shares of SharpSpring for $17.10 per share in cash, representing a 21% premium over SHSP’s closing price of $14.11 as of June 21.

The deal is expected to close in the third quarter of 2021, and is approved by SharpSpring’s Board but is subject to the company’s shareholder approval and other customary closing conditions.

Rick Carlson, SharpSpring’s CEO said, “Today is a great day for SharpSpring and our stockholders as this transaction brings immediate and certain value at an attractive premium…I am thrilled with the opportunity to bring SharpSpring’s revenue growth platform to Constant Contact’s nearly 500,000 small business customers while also further investing in and building upon SharpSpring’s strong customer and digital marketing agency base.”

The management of Clearlake and Siris said, “This investment augments Constant Contact’s digital marketing software platform by significantly accelerating its product roadmap and enhancing the tools we offer modern-day marketers in their pursuit of key revenue-generating activities.”

The combination with SharpSpring will enable Constant Contact’s SMB customers to deliver effective marketing results, as both the companies focus on small businesses.

Following the news of the acquisition, Needham analyst Scott Berg downgraded the stock to a Hold rating. Berg believes the bid is competitive and does not anticipate any superior bid at SHSP’s current valuation. The analyst said, “We view this 21% premium at ~7x FY22 revenues as fair value for a company that will likely not optically show revenue growth acceleration from current high-teens levels until the calendar year 2022.”

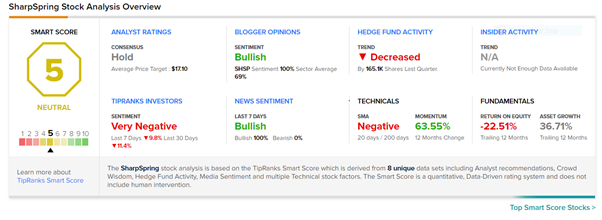

According to TipRanks’ Smart Score system, SharpSpring gets a 5 out of 10, which indicates that the stock is likely to perform in line with market averages. Shares have gained 108.3% over the past year.

Related News:

Ingersoll Rand Inks €431.5M Deal to Buy Seepex

Butterfly Network Soars on Getting a Buy from Cowen

MicroStrategy Adds Bitcoins Worth $489M; Shares Plunge 10%