Shares of tech-savvy appliance maker SharkNinja (NYSE:SN) have been on an impressive bullish ascent since the firm’s IPO last year. SN stock is now up 209% from its all-time low. The blistering momentum is on the back of explosive growth in a wide range of kitchen appliances that seem to have been “reinvented” with impressive tech prowess. As the firm looks to roll out a new slate of products in the second half of the year, I have to stay bullish on SN stock. It’s one of the most intriguing, high-growth hidden gems on the market.

Though household appliances are mostly commoditized, SharkNinja is making a wide range of various goods around the home better, thanks in large part to the firm’s willingness to innovate. Indeed, it’s never fun to do chores around the house, especially if you’re using a cheap device to get the job done.

Shark and Ninja: Not Shying Away from Innovation

Though Shark (the brand for floor care) and Ninja (primarily kitchen appliances) products are competitively priced, they punch well above their weight class. Whether we’re talking about much-appreciated convenience features with a Shark vacuum cleaner or how well it performs versus competing products, it’s clear the Shark and Ninja brands have what it takes to keep up with the priciest offerings in their respective product categories.

Amid an inflationary environment, consumers have been all about maximizing value from every purchase. Value maximizing is more than just reaching the cheapest item in its class, though. It’s more about finding the balance between price and key factors such as performance, quality, and innovative features.

Consumers don’t need to skimp on any of these areas when it comes to the Shark and Ninja line of products. Simply put, SharkNinja creates products at reasonable prices. And as it continues to do so, it may have more gas in the tank to take a big chunk of market share from rivals, including Dyson at the high end.

With one of the best value propositions in the appliance market, it’s no mystery why people have embraced SharkNinja. It’s not just offering high-quality, high-performing products at good prices that are a source of the company’s competitive edge, either. SharkNinja is actually listening to its consumers and is delivering on it in an impressive fashion.

As the firm analyzes customer interaction and feedback, it will know exactly which areas it needs to innovate in a future iteration of a device. You heard that right: SharkNinja is a consumer product designer and maker that actually listens to the people who’ve used its products.

Reportedly, the company plans to release around 25 new offerings a year, 20 of which are updates to existing devices, with the other five being new items based on the firm’s analysis of customers. Such a tech-esque, data-driven approach to building products should keep SharkNinja constantly on the cutting edge of each device category. With a reputation for doing such, SharkNinja may possess an economic moat that’s quite wide for a company of its size ($11 billion valuation).

Competitive Pricing Is the Name of the Game

Even as inflation dies down and consumers find themselves with a bit more cash to splurge on a fancier comparable (think those expensive Dysons), I expect the power of the Shark and Ninja brands to continue to propel growth for many years to come. Indeed, it’s quite rare for a relatively young brand (it’s been around for less than 30 years) to establish itself so well in a fiercely competitive market.

Perhaps Bank of America Securities analyst Alexander Perry put it best: SharkNinja caters to its retailer’s pricing strategy. This way, SharkNinja can ensure it nails down the perfect pricing for any given product.

Mr. Perry currently has a Buy rating on the stock alongside a $90 price target, which entails a nearly 14% gain from here. Mr. Perry sees more growth ahead as the firm looks to give customers exactly what they want, even before they know they want it.

For the first quarter, net sales surged to $1.07 billion, up nearly 25% year-over-year. Over the longer haul (five years and beyond), management is looking for the international business to become a more significant growth driver such that it tops the U.S. business.

As the company focuses on delivering best-in-class value for existing product categories, management is also looking to expand into new frontiers. Notably, the outdoor/sporting goods scene could be an area where SharkNinja could replicate the success it had in home goods. As Mr. Perry highlighted, the FrostVault cooler is just one product that’s experienced early success. It does the job of keeping food chilled quite well, and it does so at a price that won’t break the bank.

As for the stock’s pricing, shares look to be on the pricy side at 20.4 times forward price-to-earnings (P/E), well above the furnishings, fixtures, and appliances industry average of 13.6 times. With an impressive growth playbook, though, such a premium seems well worth paying.

Is SN Stock a Buy, According to Analysts?

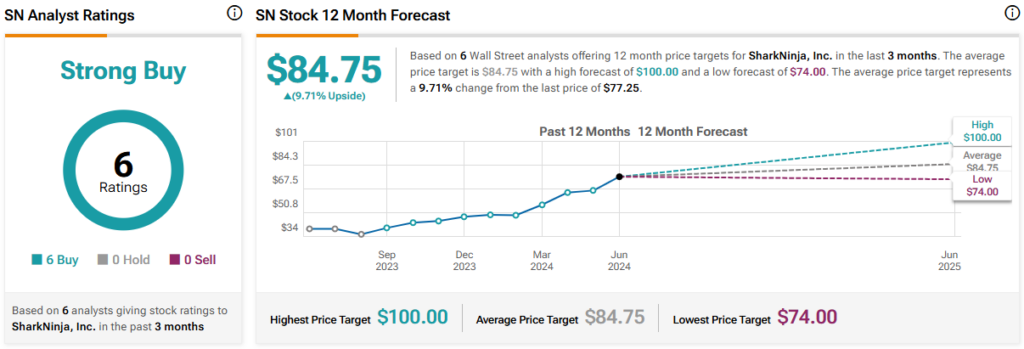

On TipRanks, SN stock comes in as a Strong Buy. Out of six analyst ratings, there are six unanimous Buys. The average SN stock price target is $84.75, implying upside potential of 9.7%. Analyst price targets range from a low of $74.00 per share to a high of $100.00 per share.

The Bottom Line on SN Stock

SharkNinja is one of those customer-driven companies that could really disrupt the consumer product scene. As the firm continues bettering existing products while expanding into new product categories, it’s tough to bet against the firm as it looks to extend its rally.

Questions or Comments about the article? Write to editor@tipranks.com