ASX-listed Life360, Inc. (AU:360) stock fell sharply as CEO Chris Hulls sold 863,903 shares in the company. This aligns with Hulls’ plan to diversify his financial portfolio and represents 1.2% of the company’s shares. Life360 shares dropped almost 7% in today’s session. Year-to-date, the stock has surged more than 180%, supported by the company’s robust operational performance and a positive outlook.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Life360 is a U.S.-based tech company that offers location-based services globally through its flagship product, the Life360 family social networking app.

CEO Reduces Stake in Life360

Hulls stated that the recent sale reflects his intentions to diversify his portfolio, secure his family, and pursue substantial philanthropic initiatives. He plans to donate more than a third of the shares to a private foundation and a donor-advised fund. Despite the sale, Hulls retains nearly 75% of his net worth in Life360 equity, demonstrating his strong commitment.

Following this transaction, Hulls will retain a 3.8% ownership stake in the company.

Life360 Hits Subscriber Milestone in Q3 Results

In Q3, Life360’s subscriber growth reached a new milestone with 159,000 new paying circles added in the quarter, up from 132,000 in Q2. Meanwhile, Life360 closed the period with 76.9 million global monthly active users. This marked 32% year-over-year growth, surpassing analysts’ expectations of 74.9 million.

Additionally, the third-quarter revenue totalled $92.9 million, reflecting an 18% year-over-year increase.

Moving forward, Life360 revised its full-year sales forecast to range between $368 million and $374 million, down from the earlier projection of $370 million and $378 million.

Is Life360 a Good Stock to Buy?

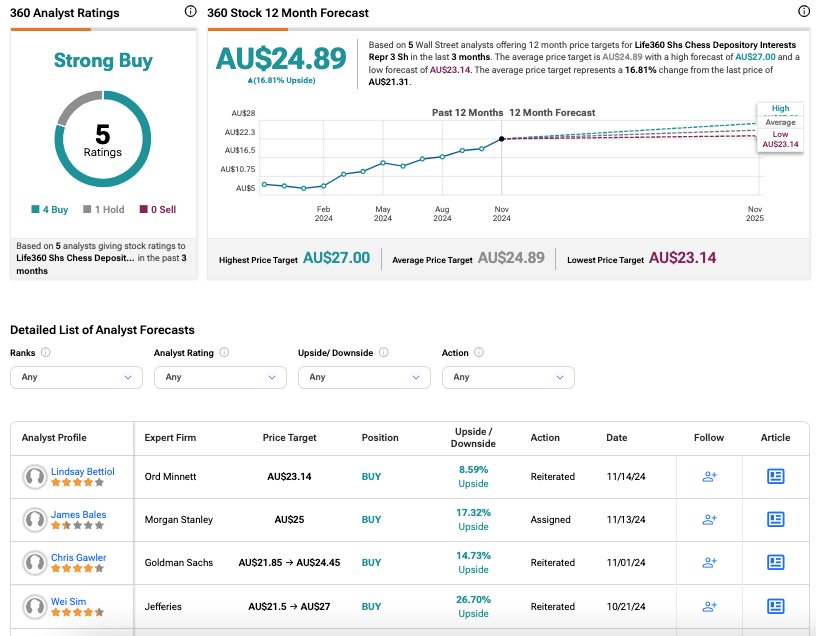

Analysts remain bullish on Life360 stock, as reflected by its Strong Buy rating on TipRanks. Following the Q3 results, Ord Minnett reaffirmed a Buy rating. Morgan Stanley also assigned a Buy rating, citing the company’s strong financial performance and positive growth metrics.

According to TipRanks’ rating consensus, 360 stock has received four Buy and one Hold recommendations from analysts. The Life360 share price target is AU$24.89, which is 17% above the current price level.