Educational publisher Pearson (GB:PSON) saw a huge jump in profits to £131 Million from just £18 Million in the first half of 2021 – and shares soared as a result.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The results pushed the share price up by around 12%, making it the top gainer in the FTSE 100 index on Monday. The stock has offered an impressive return of 44% in the year to date.

Growth across segments

Pearson’s total sales grew by 6% to £1.8 Billion, mainly driven by its English language learning segment, which grew by 22% in sales on an underlying basis. The segment still made an operating loss of £4 Million, down from a loss of £13 million last year.

Its assessment and qualification segment grew by 16%, supported by the revival of the exam schedule post the pandemic. Within this segment, clinical assessment outperformed expectations and grew by around 14% because of increased focus on mental well-being.

In virtual learning, revenues grew by 3% but the operating profit was down by 21%, due to large investments in the virtual platform, designing the curriculum, and managing after-sales services.

With good numbers in its results, the company is optimistic about the full-year guidance numbers. It has also increased its dividend by 5% to 6.6p per share.

The company has a dividend yield of 2.71% as compared to the sector average of 0.54%.

Growing digitally

Because of the closure of its learning centres during the pandemic, Pearson faced a slowdown in demand. This hurt the margins for the company, especially in the U.S.

The company has embraced the trend for digital learning and is working towards moving from a traditional to a ‘digital first’ publishing model.

The company is making slow but steady progress in this business. It expects the sales from the virtual segment to see a mid-single-digit growth in the 2022 financial year.

Pearson also undertook a major restructuring programme in 2021, which led to cost savings and margin improvement. The company has around £100 Million of savings expected in 2023, which will lead to improved margins in 2023.

View from the city

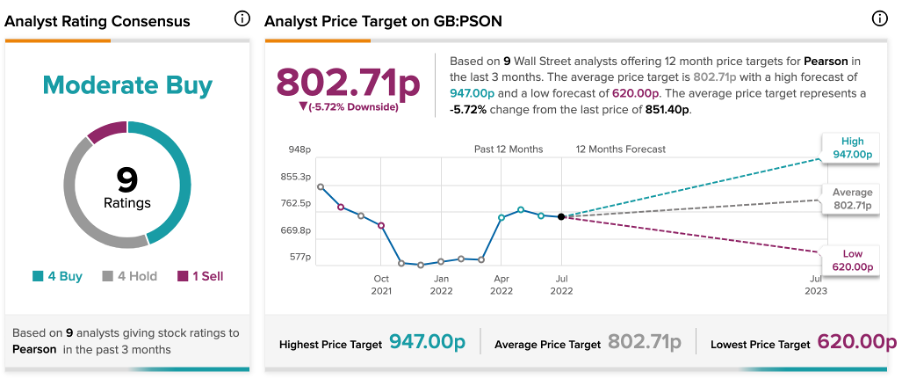

According to TipRanks’ analyst rating consensus, Pearson stock has a Moderate Buy rating. This is based on nine ratings, including four Buy, four Hold, and one Sell recommendation.

The average price target is 802.71p, which is around 5.7% lower than the current price level. The price has a high forecast of 947p and a low forecast of 620p.

In June 2022, Silvia Cuneo from Deutsche Bank upgraded her rating from Buy to Hold on the stock. She also increased the price target from 625p to 900p. She believes that the company is in a stable growth phase now.

Conclusion

The company is yet to make any outstanding achievements in its virtual learning business but the long-term prospects are good. With a focus on digital services, the revenues are predictable and the management expects stable returns for its shareholders.