Canaccord Genuity has decided to take a more cautious stance on SentinelOne (NYSE:S), downgrading it to Hold and trimming the price target to $14 from $20. This decision follows SentinelOne’s less-than-stellar Q1 performance and its reduced revenue forecast for Fiscal Year 2024. The company’s revenue outlook was affected by a challenging macroeconomic environment, impacting deal sizes and the rate of turning leads into sales. This combination of news sent shares plunging at the time of writing.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Canaccord’s Hold rating was largely influenced by SentinelOne’s decelerating growth and sizable operating losses, coupled with the changes in ARR calculation. The analysts predict that these factors—accounting adjustments, reduced guidance, and the absence of profits—could put the company’s shares at a disadvantage compared to other cybersecurity stocks, potentially remaining ‘in the penalty box’ for a few quarters.

Similarly, BTIG has also moved its rating to Neutral from Buy. BTIG highlighted concerns about the company’s recent performance, competitive landscape, and the macroeconomic effect on its operations, stating it needs evidence of stable performance over the next few quarters to restore confidence.

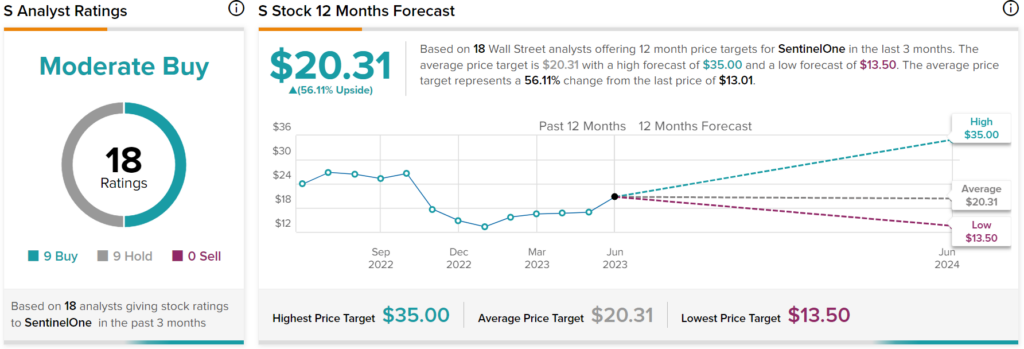

Overall, Wall Street analysts have a consensus price target of $20.31 on SentinelOne stock, implying 56.11% upside potential, as indicated by the graphic above.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue