Semtech Corporation (SMTC) reported solid first-quarter results driven by continued momentum in the IoT (Internet of Things), Optical Infrastructure, and Mobile segments.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Semtech is a global supplier of high-performance analog and mixed-signal semiconductors and advanced algorithms for infrastructure, high-end consumers, and industrial end markets.

The company reported earnings of $0.53 per share, up 51.4% compared to the prior-year quarter, and beat analysts’ expectations of $0.52 per share.

Net sales for the quarter came in at $170.37 million, up 28% year-over-year, including Wireless and Sensing products group net sales growth of 78%. Sales also outpaced the Street’s estimates of $164.31 million. (See Semtech stock analysis on TipRanks)

Mohan Maheswaran, Semtech’s President and CEO said, “We believe we are very well positioned to continue the recent momentum into our fiscal Q2 as record demand, record bookings and record starting backlog highlight the underlying strength of our core growth engines and should enable the Company to deliver a record financial performance in FY22.”

For the fiscal second quarter, the company projects net sales to fall in the range of $177 to $187 million and adjusted earnings to be in the range of $0.57 – $0.65 per share. The Street estimates sales and earnings of $168.97 million and $0.57 per share, respectively.

Following the results, Oppenheimer analyst Rick Schafer reiterated a Buy rating on the stock with a price target of $80, which implies 29.2% upside potential to current levels.

Schafer said, “Over its 60-year history, SMTC has evolved from a predominantly military/aerospace-centric company into a diversified analog IC entity, serving the consumer and industrial segments as well as comms and computing… Investors are most excited about their IoT product ‘LoRa’, which has a 5-year long term growth outlook of 40% CAGR.”

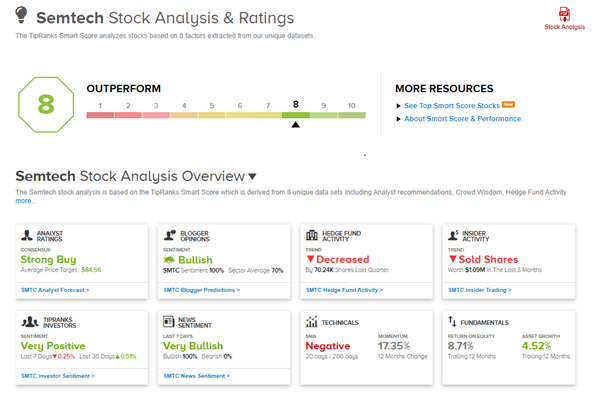

The stock has a Strong Buy consensus rating based on 8 Buys and 1 Hold. The average analyst price target of $84.56 implies 36.5% upside potential to current levels. Shares have gained 14.7% over the past year.

Semtech scores an 8 of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Zoom Q1 Earnings & Revenue Outperform; Raises FY22 Guidance

Iteris Reports Q4 Loss, Beats Revenue Expectations

Old National and First Midwest Ink All-Stock Merger Deal