With the new year upon us, Apple (NASDAQ:AAPL) investors will be hoping for a repeat of 2023’s exploits as the shares recorded gains of 48% over the course of the year.

Fat chance of that happening though. Well, that is essentially the view of Barclays’s Tim Long, , a 5-star-rated analyst ranking in the top 4% of Wall Street’s stock experts, who thinks Apple bulls are in for a rude awakening this year.

“IP15 (iPhone 15) has been lackluster and we believe IP16 should be the same,” the 5-star analyst said. “Other hardware categories should remain weak, and we don’t see Services growing more than 10%. We expect reversion after a year when most quarters were missed and the stock outperformed.”

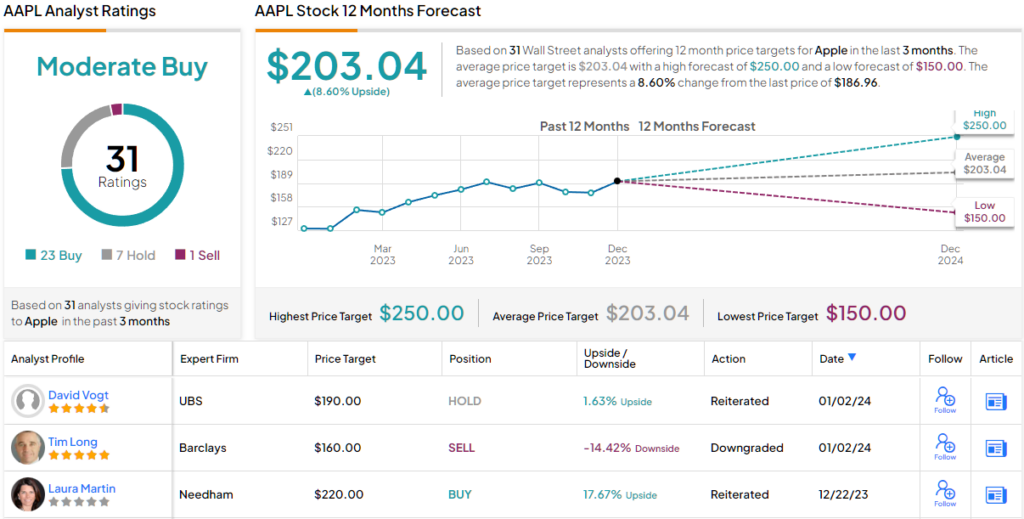

In light of these concerns, Long has downgraded AAPL’s rating from Equal Weight (i.e., Neutral) to Underweight (i.e., Sell), making him the lone bear on the Street. At the same time, the analyst has lowered his price target from $161 to $160, indicating Apple shares are currently overvalued by approximately 14%. (To watch Long’s track record, click here)

These revisions stem from Long’s recent analysis, where he continued to observe weakness in iPhone sales volume and product mix. Additionally, there is limited evidence of a resurgence in Macs, iPads, and wearables. Most concerning is the fact there have been “incrementally worse” IP15 data points coming out of China, combined with a soft performance in developed markets. “There is some emerging market strength, but not enough to offset,” Long further said.

Although the December quarter results are likely to meet expectations, Long sees trouble ahead and has further reduced expectations for the March quarter (which were already below consensus). While the Street is factoring in a performance “10 points above seasonal,” Long anticipates a “close to seasonal” display.

Don’t expect the ever-growing Services business to pick up the slack either. While comps for the December quarter are relatively light with the App Store tracking at 10% growth compared to last year, by the September 2024 quarter, Long thinks that will decelerate to MSD (mid-single-digits).

Speaking of September, it is traditionally when Apple unveils the latest iPhone iteration. However, Long does not anticipate this event to significantly shift market sentiment either. He expects “continued iPhone weakness” even with the launch of the iPhone 16, explaining, “Our checks remain negative on volumes and mix for iPhone 15, and we see no features or upgrades that are likely to make the iPhone 16 more compelling.”

So that is Barclays’ downbeat assessment, but what does the rest of the Street think lies in store for Apple this year? Well, none are as bearish as Long. All in all, the stock claims a Moderate Buy consensus rating, based on 23 Buys, 7 Holds and Long’s lone Sell. At $203.04, the average target makes room for ~9% from current levels. (See Apple stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.