Segro has entered into an agreement to snap up an additional 74.9% stake in Sofibus Patrimoine at a premium price of €313.71 per share, in a move to boost its footprint in the Paris urban warehouse market.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The purchase price translates into a 46.6% premium to Sofibus’ closing share price on Dec. 11. Segro (SGRO) will pay an aggregate €178.6 million for the stake, which puts the company value at 238.5 million. Upon completion of the transaction, the British real estate investment trust will own 94.4% of Sofibus, following its acquisition of a 19.5% interest in 2018.

As part of the deal, Segro plans to file a mandatory tender offer for the Sofibus shares, it doesn’t already own at the same offer price of €313.71 per share. Additionally, the trust intends to implement a squeeze-out procedure in order to delist Sofibus from Euronext Paris.

“This is a rare opportunity to significantly increase our exposure to urban warehousing in Paris which has long been a core market for Segro,” Segro CEO David Sleath said. “Our local team has intimate knowledge of the Paris warehouse market and will deploy its expertise to add value by actively managing Sofibus’s existing assets and by developing new, state of the art warehousing on the adjacent plots of land to satisfy growing occupier demand.”

Segro disclosed that the acquisition increases the size of its real estate portfolio in Paris by about one-third. The real estate trust manages 8.1 million square metres of space valued at £13.3 billion as of June 30, with properties located in and around major cities and at key transportation hubs in the UK and in seven other European countries.

The transaction, which is expected to close by December 21, 2020, will be financed from cash and the company’s existing debt facilities, the company said. (See SRGO stock analysis on TipRanks)

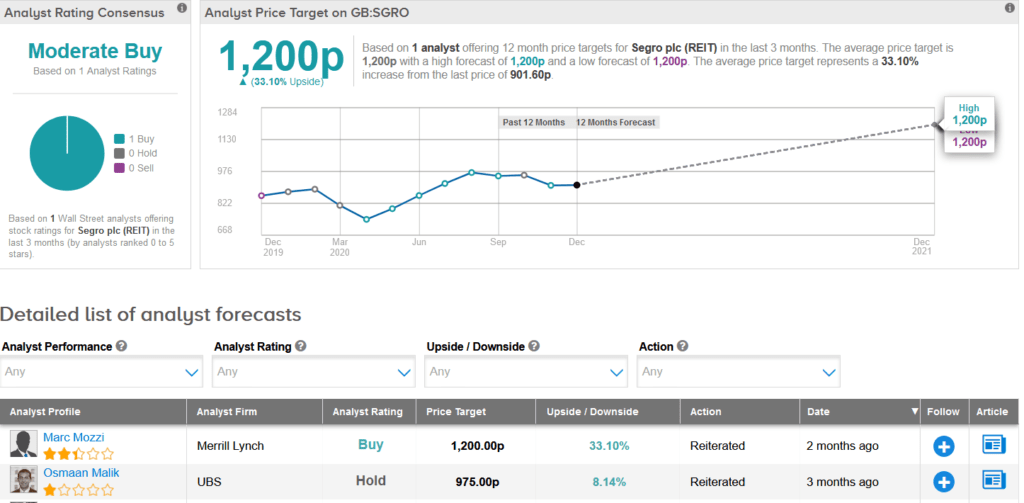

Merrill Lynch analyst Marc Mozzi recently reiterated a Buy rating on Segro stock and maintained a price target of 1,200p, suggesting investors can expect to see 33% upside over the coming year.

Related News:

JD Sports Buys Shoe Palace For $681M; Shares Jump 5%

Uber Fined $59M For Failure To Release Data In Sexual Assault Probe

Advanced Energy Introduces Quarterly Dividend Plan; Shares Rise