Bitwise’s Chief Investment Officer, Matt Hougan, has indicated that the Securities and Exchange Commission (SEC) may push back the approval of eagerly awaited Ethereum (ETH-USD) exchange-traded funds (ETFs) to December.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

After its spot Bitcoin ETF debut, which rapidly amassed over $2 billion and ranked fifth in what’s been dubbed by the cryptocurrency community the “Cointucky Derby,” Bitwise now faces another showdown with the SEC. Despite the expected delay, Hougan remains optimistic, proposing that a more gradual introduction to Ethereum ETFs could allow traditional finance more time to acclimate to the crypto ecosystem, potentially setting the stage for a stronger market entry.

Simultaneously, Consensys, the company behind MetaMask, has actively lobbied for the SEC’s approval of spot market Ethereum ETFs, citing Ethereum’s shift to a proof-of-stake consensus as a superior security measure compared to Bitcoin’s proof-of-work system. Consensys championed Ethereum’s robust security framework in a persuasive letter to the SEC, arguing for the unfounded nature of the SEC’s fraud and manipulation concerns.

Ethereum Technical Analysis

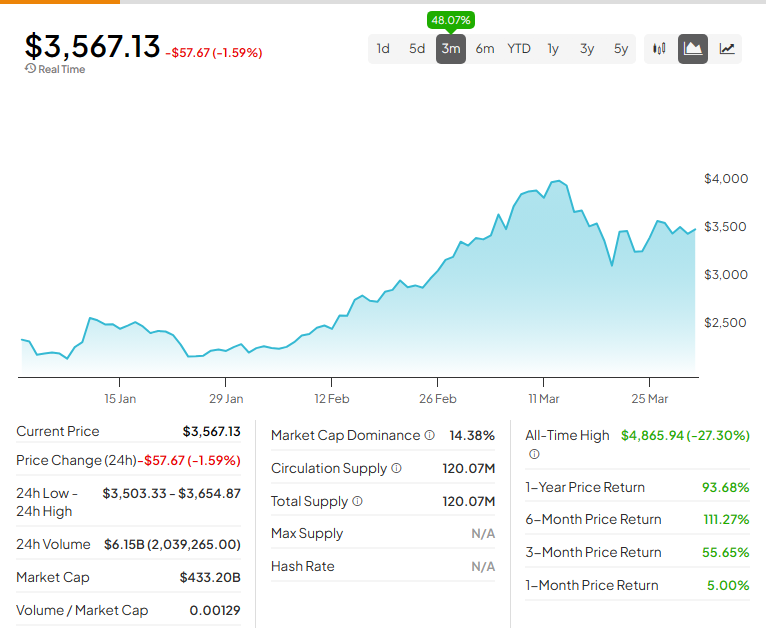

Ethereum’s price action over Easter Weekend ended on a positive note. ETH ended lower on Saturday, but only slightly (-0.10%). Its performance on Sunday, however, was a very different story, as Etheruem closed higher by nearly +4% in the $3,650 value area. Sunday’s close resulted in the highest daily close since March 15.

On a weekly timeframe, the TipRanks summary of indicators shows Ethereum’s current MACD indicator at 393.07, typically signaling a Sell due to the potential downward momentum. However, the broader context of Ethereum’s market performance, particularly its exponential moving averages, tells a more bullish story.

The 20-period EMA of Ethereum at $3,014.89 is significantly below its current price of $3,610.09. Similarly, the 50-period EMA is $2,502.46, also well below the current price. These indicators typically suggest a bullish trend, as the current price exceeds short-term and medium-term moving averages, indicating strong buying pressure and potential for continued upward movement.

On a monthly time frame, Ethereum ended March higher with a gain of +9.09%, but off of its monthly highs near $4,100.

Don’t let crypto give you a run for your money. Track coin prices here