Crypto enthusiasts can now breathe a sigh of relief. The SEC has decided not to push for a court ruling that would classify popular crypto tokens like Solana (SOL-USD), Cardano (ADA-USD), and Polygon (MATIC-USD) as securities in its lawsuit against Binance. This shift, revealed in a filing on July 30, 2024, means the court won’t need to decide whether these tokens are securities for now.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

What’s Happening with the Tokens?

The SEC initially targeted several tokens, including BNB (BNB-USD), Binance USD (BUSD-USD), Solana, Cardano, Polygon, and others, in its broad claim that these could be classified as securities. In June 2023, the SEC argued that at least 68 tokens were securities, potentially affecting over $100 billion in the crypto market, according to CoinTelegraph.

Changing Views on Crypto

The SEC’s retreat comes amid shifting attitudes towards crypto in the US. On July 27, former President Donald Trump pledged to end the “war on crypto” if re-elected, promising to make the US the “crypto capital of the planet” and vowing to replace SEC Chair Gary Gensler. Meanwhile, Democratic members of Congress are also reassessing their stance, with some calling for a more “forward-looking approach” to digital assets. Advisors to Vice President Kamala Harris are reportedly reaching out to crypto firms to mend ties with the industry, according to DLNews.

A Silver Lining for Crypto Investors

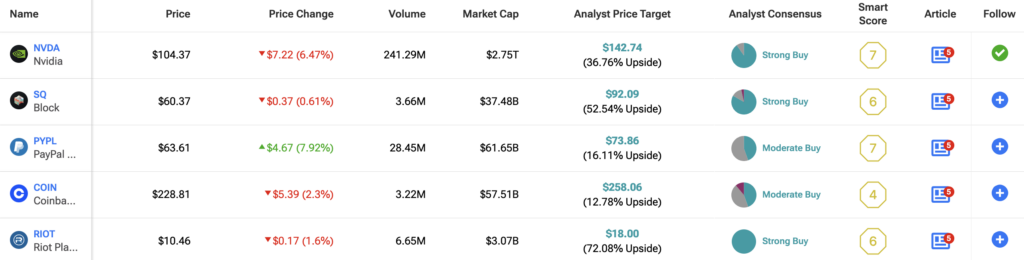

Amidst this positive development, investors might want to consider exploring crypto-related stocks that could benefit from this news. With the SEC stepping back, companies involved in crypto infrastructure, exchanges, and blockchain technology may see a boost. Stocks of firms like Coinbase (COIN) and crypto mining companies might gain traction as the regulatory uncertainty around major tokens eases.

Investors can compare the cryptocurrency stocks using the TipRanks Stocks Comparison tool.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue