American biotechnology company Seagen (SGEN) develops cancer treatments and has launched several medicines in the market. The company continues to work on expanding its product portfolio and maximizing the potential of its approved drugs. (See Top Smart Score Stocks on TipRanks)

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

With this in mind, we used TipRanks to take a look at the newly added risk factors for Seagen.

Q3 Financial Results

In Q3 2021, Seagen reported $424.1 million in revenues, significantly less than the $1.1 billion earned in the same quarter last year, yet surpassing the consensus estimate of $383.3 million.

However, the company posted a loss per share of $1.61, missing the consensus estimate of a $0.57 loss per share. The company ended Q3 with $2.4 billion in cash. (See Seagen stock charts on TipRanks)

Risk Factors

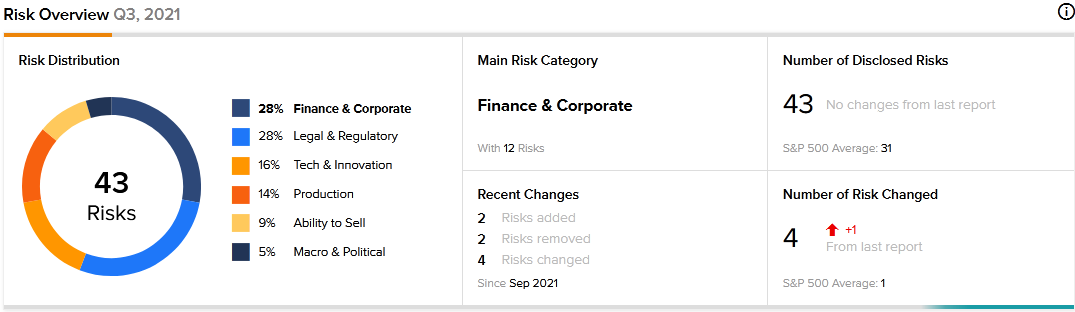

Seagen carries 43 risk factors, according to TipRanks’ Risk Factors tool, and the company has updated its risk profile with two new risk factors.

Seagen has told investors that many of its activities are conducted remotely due to the COVID-19 pandemic, which could increase its cybersecurity risk. The company has further warned that a breach of its IT system could disrupt its clinical trials, harm its reputation, and result in revenue loss.

The company has also informed investors that efforts to contain healthcare costs in the U.S. have reduced its revenue and increased its expenses. According to the company, sales and expenses could be adversely impacted in the future, with sustained efforts to reform healthcare.

Most of Seagen’s risk factors fall under the Finance and Corporate category. Seagen’s stock price has gained about 2% since the beginning of 2021.

Analysts’ Take

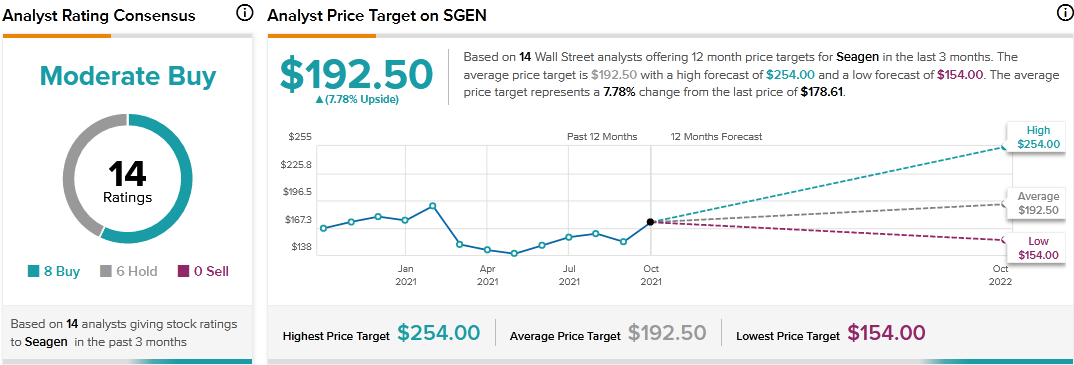

Following Seagen’s Q3 earnings report, Piper Sandler analyst Joseph Catanzaro maintained a Hold rating on Seagen stock but raised the price target to $165 from $160. However, Catanzaro’s new price target implies 7.62% downside potential.

Overall, the stock has a Moderate Buy consensus rating based on 8 Buys and 6 Holds. The average Seagen price target of $192.50 implies 7.78% upside potential to current levels.

Related News:

NIO’s October Deliveries Drop 27.5%; Shares Gain

Chegg Drops 29% as Q4 Guidance Disappoints, Q3 Revenues Miss Estimates

Cargojet Q3 Revenue Rises 17%; Shares Dip