Investing in dividend ETFs can be one of the best ways to safeguard your portfolio and earn consistent dividend income. We leveraged the TipRanks Compare ETFs tool for High Dividend Yield ETFs to explore the top three high dividend yield ETFs, namely: Global X SuperDividend ETF (SDIV), iShares Emerging Markets Dividend ETF (DVYE), and Global X MSCI SuperDividend Emerging Markets ETF (SDEM).

TipRanks’ ETF Comparison Tool enables the comparison of ETFs based on several parameters, including AUM (assets under management), funds flow, expense ratio, technicals, dividend analysis, and performance over different periods. Let’s learn more about the top three high-dividend-yield ETFs.

Global X SuperDividend ETF (SDIV)

The Global X SuperDividend ETF invests in 100 of the highest dividend-paying companies from across the globe. SDIV seeks to track the performance of the Solactive Global SuperDividend Index. The worldwide equity exposure enables the ETF to diversify its holdings both in terms of geography and interest rate risks. SDIV has made consistent monthly dividend distributions for the past 12 years.

SDIV currently pays a regular monthly dividend of $0.19 per share, reflecting an attractive trailing twelve-month (TTM) yield of 10.7%. Plus, SDIV has a moderate expense ratio of 0.58%.

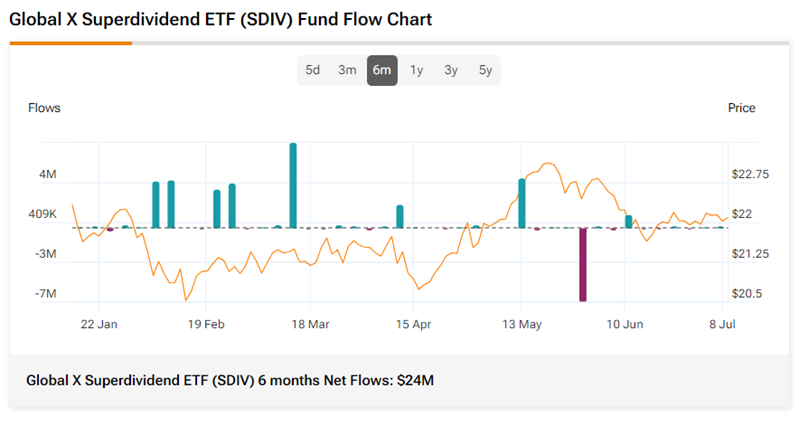

As of July 5, SDIV had 102 holdings, with a total AUM (assets under management) of $777.50 million. Its top three holdings include Lufax Holdings (LU), Yue Yuen Industrial (HK:0551), and Agas Gas Holding. In the past six months, SDIV has witnessed net inflows of $24 million.

iShares Emerging Markets Dividend ETF (DVYE)

The iShares Emerging Markets Dividend ETF seeks to track the performance of the Dow Jones Emerging Markets Select Dividend index. This index follows a dividend-weighted methodology to select roughly 100 stocks from emerging markets. The exposure to well-established companies from emerging markets enables the index to earn high dividend yields.

Remarkably, DVYE pays a regular quarterly dividend of $0.71 per share, reflecting a current TTM yield of 8.16%. Also, DVYE has one of the lowest expense ratios of 0.49% of the three ETFs.

As of July 10, DVYE had 110 holdings in its portfolio, with an AUM of $689.41 million. The top three holdings include Petroleo Brasileiro SA, Vedanta Limited, and Vale S.A. Unfortunately, in the past six months, DVYE has witnessed net outflows of $27 million.

Global X MSCI SuperDividend Emerging Markets ETF (SDEM)

The Global X MSCI SuperDividend Emerging Markets ETF invests in 50 stocks carrying high dividend yields from emerging markets, offering great growth potential. SDEM seeks to track the performance of the MSCI Emerging Markets Top 50 Dividend Index, which selects stocks based on high dividend yields.

SDEM pays a regular monthly dividend of $0.14 per share, reflecting a TTM yield of 7.14%. Importantly, SDEM has paid consistent monthly dividends for the last nine years. Out of the three ETFs, SDEM has the highest expense ratio of 0.68%.

As of July 11, SDEM had 52 stocks in its portfolio, and its AUM is comparatively small at $46.18 million. SDEM’s top three holdings include Compania Sud Americana de Vapores, Santander Bank Polska, and Sasol Limited. Similar to DVYE, SDEM also witnessed net outflows of $2 million in the past six months.

Key Takeaways

The Global X SuperDividend ETF appears to be the best pick among the three ETFs based on their dividend yields. The SDIV ETF also has a more diversified exposure to global equities, a moderate expense ratio, and a growing asset base, making it an attractive option.