According to a new Scotiabank (BNS) poll, three-quarters of Canadians are concerned about their financial situation.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

They spend an average of 10 hours a week worrying about it, or the equivalent of three weeks a year, up 25% from 2020. One-third of Canadians say their financial worries prevent them from sleeping.

Concerns about Investments, Debt and Retirement

The results of the third annual Scotiabank Financial Concerns Survey show that Canadians are most concerned about growth and protection of their investments, their ability to pay their current expenses, and repayment of their debts.

Saving for retirement is a growing concern for Canadians, with 12% now expressing concern about planning for retirement, up from 8% in 2020.

Personal finances are fourth (33%) on the list of stressors for Canadians, just behind the increase in the cost of living (52%) and their physical health (45%).

Management Commentary

“More Canadians are being kept up at night with questions like, how they’re going to own a home, will they have enough to pay for their children’s education, and if they’ll have enough for retirement” said D’Arcy McDonald, Senior Vice President, Deposits, Investments & Payments at Scotiabank. “Peace of mind starts with a simple conversation. We encourage all Canadians to speak with a financial advisor about what’s keeping them up at night so they can get advice on how to achieve their financial goals. Even that initial conversation can be an invaluable step to getting a better night’s sleep.”

CDP Assigns Scotiabank an A-

Scotiabank has been awarded an A- rating from CDP for the second year in a row, for its rigorous management of climate issues and the transparency of its declarations in this area.

Wall Street’s Take

On December 8, Canaccord Genuity analyst Scott Chan kept a Buy rating on BNS and C$89 price target. This implies 1.8% upside potential.

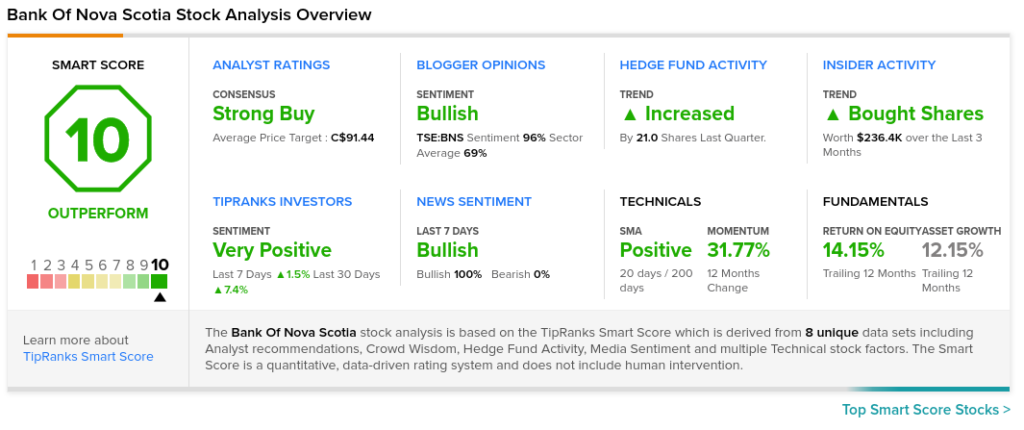

The rest of the Street is bullish on BNS with a Strong Buy consensus rating based on six Buys and two Holds. The average Bank of Nova Scotia price target of C$91.44 implies 4.6% upside potential to current levels.

TipRanks’ Smart Score

BNS scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock returns are very likely to beat the overall market.

Related News:

Scotiabank Teams with Intuit

Scotiabank, Cineplex Launch Scene+ Program

Scotiabank, BestEx Research Partner on New Trading Platform