Scotiabank (BNS) Economics’ Nikita Perevalov has just published a report on the situation of SMBs, and the major trends emerging in the business world.

The report reveals that recovery is strong, but is not affecting all sectors equally. It also highlights changes in consumption habits and a leap in e-commerce, which is becoming the new normal.

A strong economic recovery, fiscal support measures, and the adoption of new technologies could accelerate business recovery over the next six months. (See Bank of Nova Scotia stock charts on TipRanks)

“The pandemic accelerated digital transformation for small- and medium-sized businesses, and many pivoted their businesses in incredibly innovative ways,” said Jason Charlebois, SVP, Small Business at Scotiabank. “Their resiliency is something all Canadians should be proud of and now it’s our opportunity as consumers to support these businesses as they open their doors again.”

On October 4, CIBC analyst Paul Holden maintained a Buy rating on BNS and a price target of C$90. This implies 15.5% upside potential.

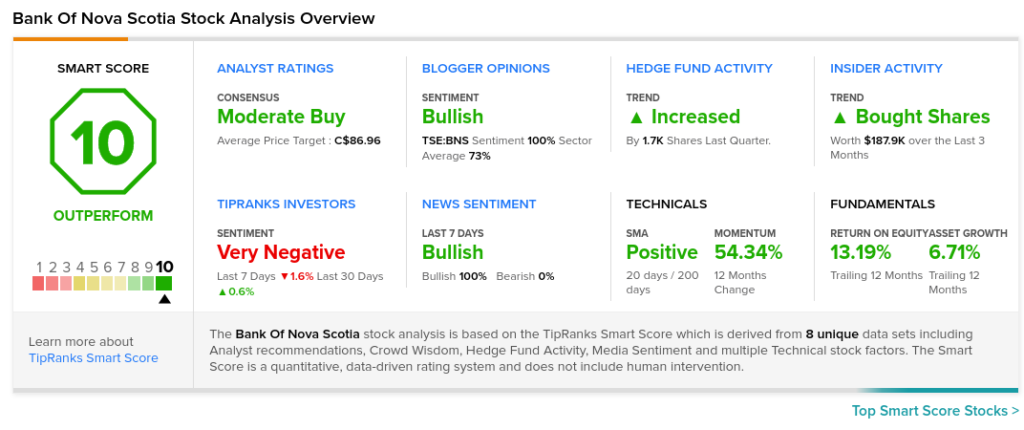

The rest of the Street is cautiously optimistic on BNS with a Moderate Buy consensus rating, based on five Buys and four Holds. The average Bank of Nova Scotia price target of C$86.96 implies 11.6% upside potential to current levels.

TipRanks’ Smart Score

BNS scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock returns are very likely to beat the overall market.

Related News:

Scotiabank Commits to Donate C$750K to Connected North

Scotiabank, Google Cloud Announce Strategic Partnership

Scotiabank Recognized Among Diverse, Inclusive Companies