Bank of Nova Scotia (BNS), Canada’s third-largest bank, announced Tuesday that it is among Refinitiv’s top 25 most diverse and inclusive companies for 20201.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

This is the fourth year in a row that Scotiabank has received this honor, which follows Refinitiv’s comprehensive analysis of more than 11,000 companies worldwide. (See Bank of Nova Scotia stock charts on TipRanks)

“This recognition confirms our ongoing commitment to fostering a diverse and inclusive culture,” said Scotiabank chief HR officer Barb Mason. “We continue to build an inclusive workplace for every future and are encouraged by our progress so far.

“We’ve set high ambitions and continue to pursue our 2025 inclusion goals and do the necessary work to sustain a culture of inclusivity across our global footprint.”

Refinitiv’s Diversity and Inclusion (D&I) index is based on data it has on environmental, social and governance (ESG) issues. This index makes it possible to assess the relative performance of companies with regard to the factors that characterize workplaces promoting diversity and inclusion.

David Harris, Global Head of Sustainable Finance, London Stock Exchange Group stated that the Refinitiv D&I Index has become the benchmark against which to assess progress. The index lists the 100 most diverse and inclusive companies in the world.

On September 7, Barclays analyst John Aiken maintained a Hold rating on BNS, and a price target of C$83. This implies 6.5% upside potential.

Following Q3 results, Aiken said in a note that while Scotiabank has performed well in its Canadian and Wealth divisions, much of the growth in its International division has been attributed to reversals on allowance for loan losses while income growth and loans were weak.

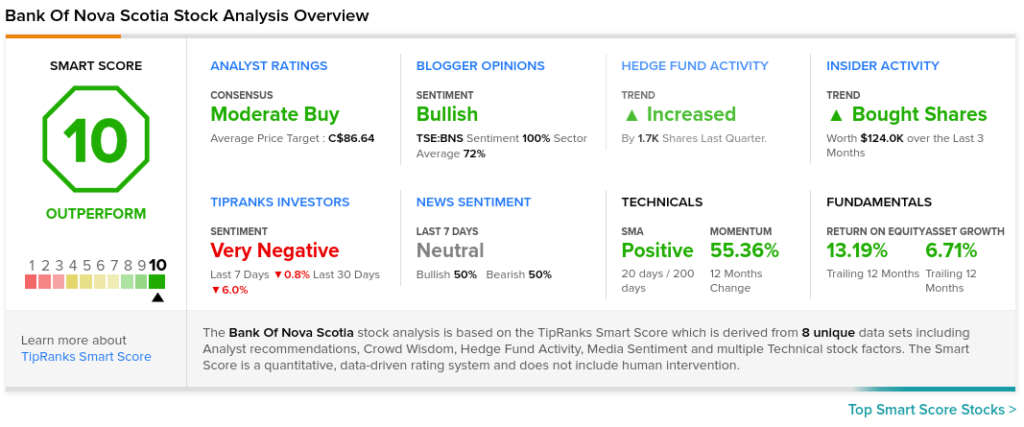

The rest of the Street is cautiously optimistic on BNS, with a Moderate Buy consensus rating based on four Buys and four Holds. The average Bank of Nova Scotia price target of C$86.64 implies 11.3% upside potential to current levels.

TipRanks’ Smart Score

BNS scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock returns are very likely to beat the overall market.

Related News:

The Scotiabank Women Initiative Surpasses C$3B Target

Scotiabank Adds Digital Enhancements to Mobile App

Scotiabank Q3 Profit Beats Expectations