Charles Schwab has completed the acquisition of rival TD Ameritrade Holding Corporation. The transaction will build a company with higher scale and a better portfolio of world-class solutions and services, the company said.

As a result of the deal, Charles Schwab (SCHW) will have combined client assets of about $6 trillion with 28 million brokerage accounts and more than 5 million daily average trades. Charles Schwab expects that the combination of the two companies will cut down on operating expenses as a percentage of client assets.

The integration of the operations of both the companies is expected to be completed over the next 18 to 36 months. The company announced the deal back in Nov. 2019. Until the integration is completed, the companies will continue to operate separate broker-dealers to serve their clients. (See SCHW stock analysis on TipRanks)

“This is a historic moment that brings together two leading companies with proud and successful histories of making investing more accessible to all,” said Charles Schwab CEO Walt Bettinger.

As part of the deal, TD Ameritrade stockholders received 1.0837 shares of SCHW common stock for each share held. The Toronto-Dominion Bank and its affiliates received common stock up to 9.9%. The aggregate number of shares of Schwab stock issuable as merger consideration was approximately 509 million shares of Schwab common stock and 77 million shares of Schwab nonvoting common stock.

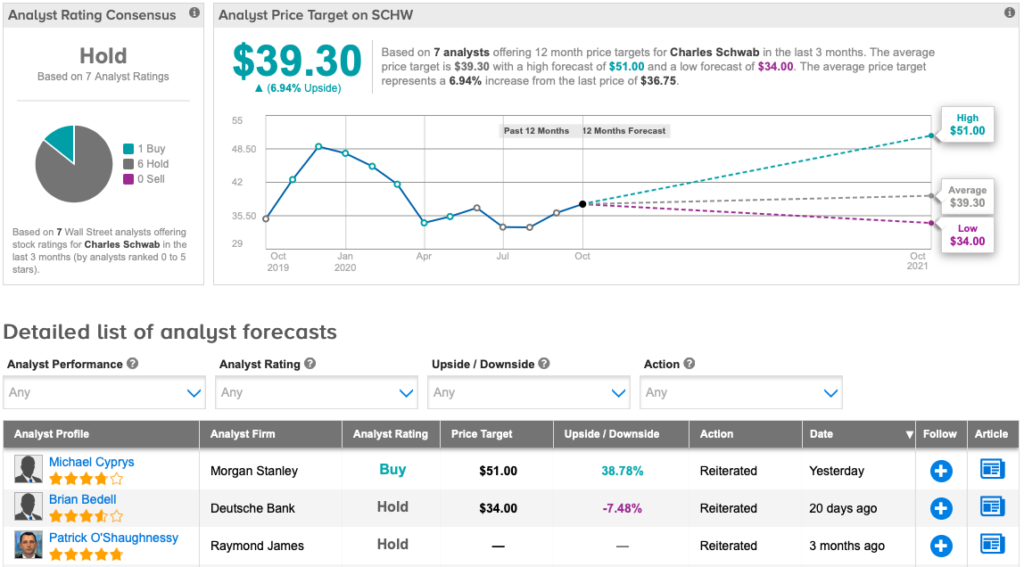

Following the news, Morgan Stanley analyst Michael Cyprys reiterated a Buy rating on the stock with a price target of 51% (38.7% upside potential). The 4-star analyst expects the company to post earnings per share of $0.48 for 4Q of 2020.

Currently, the Street has a cautious outlook on SCHW stock. The Hold analyst consensus is based on 6 Holds versus 1 Buy. The average analyst price target of $39.30 implies upside potential of about 7% to current levels. Shares have declined about 22.75% year-to-date.

Related News:

Telia Inks $1B Deal To Sell Carrier Unit, To Reinstate Dividend

BHP Snaps Up 28% Stake In Shenzi Oil Field For $505M

Welltower Appoints New CEO; Street Is Sidelined