Santander Consumer USA Holdings Inc. (SC) has agreed to go private and become a wholly-owned subsidiary of its majority shareholder Santander Holdings USA, Inc. (SHUSA) following the acquisition of its outstanding shares for $41.50 per share. The deal values SC at $12.7 billion and is expected to close in the fourth quarter of 2021. Shares of the consumer financing services provider closed at $41.31 on August 23.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The deal has been approved by the Boards of both SHUSA and SC after a unanimous recommendation by a Special Committee. However, the deal awaits regulatory approval from the Board of Governors of the Federal Reserve System. (See Santander Consumer USA stock charts on TipRanks)

Per the terms of the deal, a unit of SHUSA will offer to buy the remaining shares of SC which it does not already own for $41.50 per share in cash. Following this, SHUSA will buy the remaining shares not tendered in the tender offer for the same price under a second-step merger.

On July 1, SHUSA had offered its initial non-binding bid of $39 per share to acquire all of the remaining shares of SC that it did not already own. The revised purchase price of $41.50 represents a premium of 14% on the closing price of July 1, 2021, the date when the original offer was made.

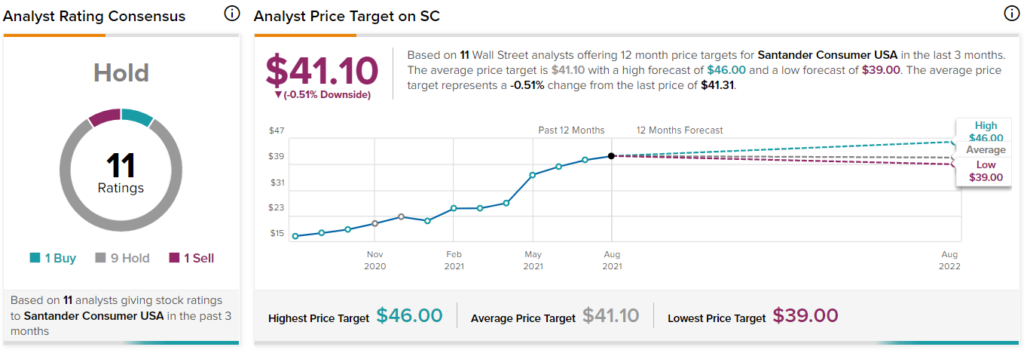

Last month, Deutsche Bank analyst Meng Jiao downgraded the SC stock to a Hold from a Buy rating while maintaining the price target of $41.

Jiao noted that the upside potential of the stock was “capped given the overhang” of the non-binding proposal from SHUSA to buy the remaining outstanding shares of SC for $39 per share.

Shares have gained 134% over the past year.

Related News:

Palo Alto Soars 10% on Robust Q4 Results & Upbeat FY22 Guidance

Scientific Games Snaps Up Sideplay Entertainment; Shares Pop 4%

KAR to Buy CARWAVE for $450M