Sanofi acquired Tidal Therapeutics, a privately held biotechnology company on Friday for an upfront payment of $160 million. The company will pay another $310 million for Tidal contingent upon achieving certain milestones.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Sanofi’s (SNY) Global Head of Research and Chief Scientific Officer Frank Nestle said, “We anticipate that this next generation, off-the-shelf approach has the potential to bring CAR-T cell therapy to a much broader patient population. We believe that the underlying mRNA targeting platform will create disruptive therapeutic approaches across a variety of oncology and autoimmune conditions.”

Tidal Therapeutics uses messenger-based ribonucleic acid (mRNA) technology based on “proprietary nanoparticles” to reprogram immune cells in vivo, that is, inside the body. Currently, the company has ongoing pre-clinical programs for the re-programming of different types of immune cells including T cells for cancer indications.

Shares of Sanofi have gained 5.8% in the past month. (See Sanofi stock analysis on TipRanks)

Last week, Barclays analyst Emmanuel Papadakis raised the price target on Sanofi from €80 to €85 and reiterated a Neutral rating on the stock.

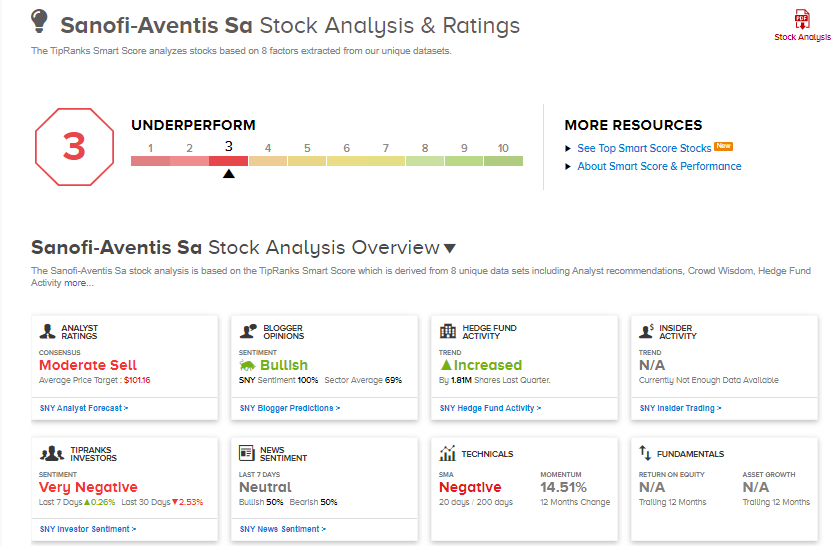

Overall, the rest of the Street has a Moderate Sell consensus rating on the stock based on 1 Hold and 1 Sell. The average analyst price target of $101.16 implies that SNY shares have approximately 99.3% upside potential to current levels.

According to the TipRanks Smart Score system, Sanofi scores a low 3 out of 10 indicating that the stock is likely to underperform to market averages.

Related News:

Microsoft Set To Acquire Nuance For $16B – Report

Levi’s 1Q Sales And EPS Beat Estimates; Street Says Buy

Provention Bio Shares Crash 40% Due To Regulatory Setback For Diabetes Drug