Salesforce reported better-than-expected 3Q results on Tuesday, reflecting strong demand for its cloud-based software solutions. Meanwhile, the company also raised FY21 revenue guidance and provided an outlook for FY22. The stock dropped 4.8% in Tuesday’s after-market trading.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Salesforce’s (CRM) 3Q sales grew 20% to $5.42 billion, topping the Street’s estimates of $5.25 billion. Moreover, its adjusted EPS soared 132% to $1.74 year-on-year, blowing past analysts’ expectations of $0.74. The company’s impressive bottom-line reflects robust revenue growth and a benefit of $0.86 per share from mark-to-mark accounting required by ASU (Accounting Standard Update) 2016-01, the company said.

“No other major enterprise software company is growing at this rate,” said Salesforce’s CEO Marc Benioff. “We’re rapidly moving to an all-digital world, where work happens wherever people are. Our results are being driven by the success of our customers and the relevance of our Customer 360 Platform in this new normal.”

Buoyed by strong quarterly results, Salesforce raised its fiscal 2021 revenue guidance range to $21.10-$21.11 billion from the $20.70-$20.80 billion projected earlier. Adjusted earnings are now expected to be in the range of $4.62-$4.63 per share, up from the previous guidance of $3.72-$3.74. As for 4Q, the company forecasts revenues and adjusted EPS in the range of $5.665-$5.675 billion and $0.73-$0.74, respectively. (See CRM stock analysis on TipRanks)

Salesforce also provided a revenue outlook for the first-quarter and fiscal 2022. For 1Q, it projects sales of between $5.680 billion and $5.715 billion. Meanwhile, it expects to generate revenues in the range of $25.45-$25.55 billion in fiscal 2022.

Separately, Salesforce announced an agreement to acquire Slack Technology in a cash and stock deal worth $27.7 billion. The company stated that the combination would form the largest open ecosystem for applications and workflows of business and would help in expanding Salesforce’s enterprise footprint. The transaction is anticipated to be completed during the second quarter of fiscal 2022.

Commenting on the acquisition, Wedbush analyst Daniel Ives said that the buyout would help Salesforce in “Keeping pace with Microsoft” and “Morphing into a broader cloud platform approach.” Ives added “We believe even once a vaccine is deployed to the masses and employees start to return to the office during the course of 2021, collaboration/messaging software will become further embedded in enterprise initiatives looking forward. This software segment has created another key penetration ramp onto the cloud which should enable Salesforce with Slack in hand to go after broader cloud initiatives and areas of the enterprise previously not touchable with its current product portfolio.”

The analyst reiterated a Buy rating on the stock with a price target of $300 (24.3% upside potential).

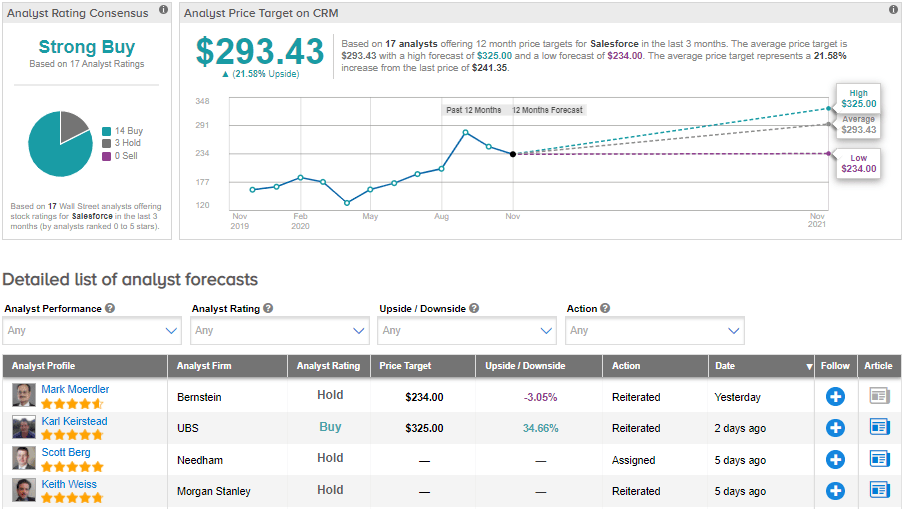

Currently, the Street has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 14 Buys and 3 Holds. The average price target stands at $293.43 and implies upside potential of about 21.6% to current levels. Shares have advanced by about 48.4% year-to-date.

Related News:

S&P Global To Snap Up IHS Markit In $44B Mega Deal; Street Stays Bullish

Amazon’s Cloud Unit To Run Apple’s MacOS System; Street Sees 21% Upside

ServiceNow Snaps Up Element AI; Stock Up 90% YTD