Ryanair Holdings Plc (RYAYY) announced that it is slashing its annual passenger target by almost 50% due to stringent public health restrictions and amid expectations of a competitive ticket price discounting environment.

Europe’s largest low-cost carrier, which plans to resume part of its flight schedule from July 1, said it expects to carry no more than 50% of its original second-quarter traffic target of 44.6 million passengers. Bookings will be impacted by public health restrictions, including temperature checks and face coverings for passengers and staff, as well as quarantine requirements, the company said. Ryanair also cut its FY21 passenger target estimate by almost 50% to 80 million passengers.

Commenting on the aviation landscape as traffic returns to scheduled flying from July, Ryanair contended that the competitive landscape in Europe will be distorted by unprecedented state aid under which over €30 billion will be given to the Lufthansa Group, Air France-KLM, Alitalia, SAS and Norwegian among others. Ryanair is not receiving any state aid.

“We therefore expect that traffic on reduced flight schedules will be subject to significant price discounting, and below cost selling, from these flag carriers with huge state aid war chests,” the company said in a statement.

Most of Ryanair’s fleet was grounded from mid-March by EU Government flight bans and restrictions due to the coronavirus pandemic. The groundings cut the airline’s March and full-year traffic by over 5 million guests and slashed FY20 profits by over €40 million, it said. The no-frills carrier said that passenger traffic in April declined 99.6% to 0.4 million customers. In the April to June quarter, Ryanair expects to operate less than 1% of its scheduled flying plan.

Ryanair shares rose 9% to $54.23 in pre-market U.S. trading as the company also announced a thorough cost-cutting plan. The low-cost carrier said that it is currently in negotiations with both Boeing (BA) and Lauda’s A320 lessors to reduce planned deliveries over the next 24 months in light of slower traffic growth post-Covid-19 this year and in 2021. As part of a cost-cutting drive, the airline will cut at least 3,250 jobs, and it is also looking to pull out of some airports across Europe.

Since mid-March, Ryanair canceled share buybacks and deferred operating and non-essential capex spending.

“As a result, average weekly cash burn has dropped from €200 million in March to just over €60 million in May,” Ryanair said. “This liquidity will enable the Group to weather Covid-19. Our focus will remain on cash preservation/generation and the repayment of maturing debt over the next 24 months.”

Looking ahead, the carrier expects to record a loss of over €200 million in the quarter ended June 30, with a smaller loss estimate in the peak summer second quarter due to a substantial decline in traffic and pricing from Covid-19 groundings.

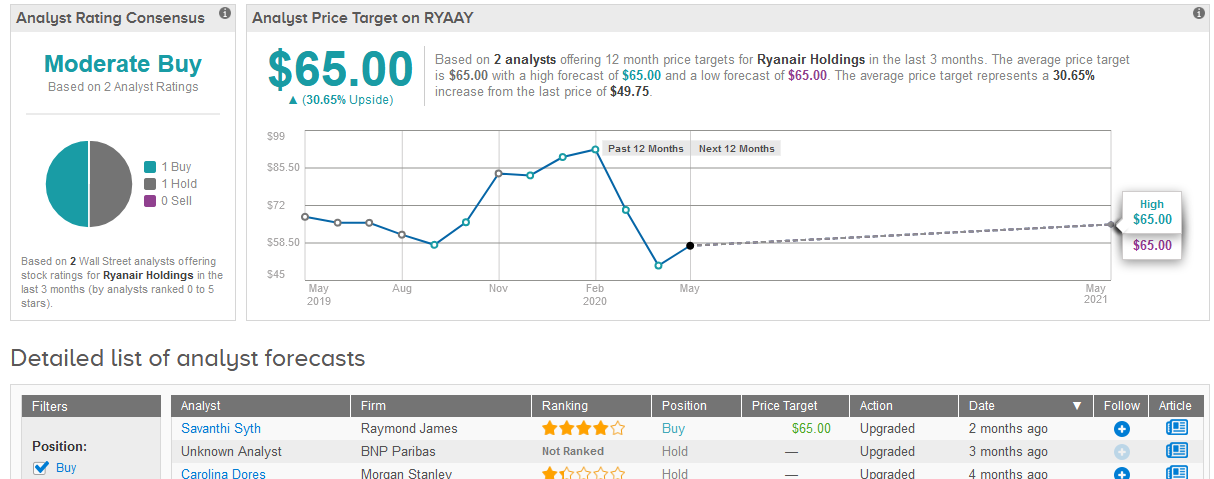

Shares in Ryanair have plunged 44% this year. TipRanks data shows that Wall Street analysts are cautiously optimistic about the stock as suggested by the Moderate Buy consensus outlook. The $65 average price target implies 31% upside potential in the shares in the coming 12 months. (See Ryanair stock analysis on TipRanks).

Related News:

Delta Air Lines to Stop Flying Boeing’s 777 Aircraft to Cut Costs

Boeing Gets No Orders in April, Customers Cancel 737 MAX Jets

Qantas Said to Halt Plane Deliveries From Boeing, Airbus Amid Travel Freeze