Behemoth aircraft maker The Boeing Co. (BA) has ended talks with Europe’s largest low-cost carrier Ryanair Holdings Plc (RYAAY) for a follow-on order for 737 MAX10 aircraft over pricing issues. Shares of Boeing closed 1.2% lower at $218.17 on September 3.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Ryanair has already placed an order for 210 smaller Max 8200 model aircraft, which Boeing will deliver over the next 5 years. The current order was for the larger MAX10 aircraft for which both companies were under negotiations for over 10 months. However, last week, both companies decided not to waste any more time on negotiations, as they could not agree on the price.

Commenting on the news, Ryanair CEO Michael O’Leary said, “We are disappointed we couldn’t reach an agreement with Boeing on a MAX10 order. However, Boeing has a more optimistic outlook on aircraft pricing than we do, and we have a disciplined track record of not paying high prices for aircraft.”

Recently, Susquehanna analyst Charles Minervino maintained a Buy rating on Boeing with a price target of $300, implying 37.5% upside potential to current levels.

Minervino revised his Boeing 737 delivery estimates to reflect the delivery interruptions as the year-end approaches. Also, he anticipates that the FAA will approve the company’s proposed remedies soon so that Boeing can deliver a few dozen aircraft in the fourth quarter.

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 8 Buys and 7 Holds. The average Boeing price target of $275.87 implies 29.5% upside potential to current levels. Shares have gained 35.4% over the past year.

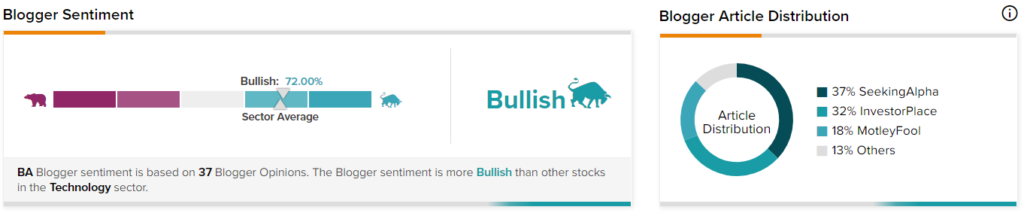

Also, TipRanks data shows that financial blogger opinions are 72% Bullish on BA, compared to the sector average of 71%.

Related News:

Moderna Submits Data for COVID Vaccine Booster to EMA

Ashland Jumps on Announcement of $450M Accelerated Share Buyback Program

TechnipFMC Sells 9.9% Stake in Technip Energies N.V.