The Russell 2000 (IWM) index of small-cap stocks has hit a fresh all-time high amid a broader rally in U.S. equities.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

The Russell 2000 hit an intraday high of 2,466.49, a record for the index that is mostly composed of stocks with market capitalizations of $10 billion or less. It was the first new all-time high for the index since 2021. The Russell 2,000 has increased 11% in the last month, including a 6% gain in the past week.

The Russell 2000 index has been marching higher amid a rally in U.S. equities following the election of Donald Trump on November 5. Small-cap stocks are expected to benefit under president-elect Trump’s incoming administration and its preference for less regulation, which is viewed as positive for smaller companies as it will help them to better compete.

Reversal of Fortune

U.S. stocks are also rising on news that Trump has nominated hedge fund manager Scott Bessent to be Secretary of the U.S. Treasury. The current rise in the Russell 2000 index represents a reversal of fortune for small-cap stocks. After underperforming the benchmark S&P 500 index for the better part of a decade, small-cap equities are once again outperforming.

The S&P 500 has increased 3% in the past month, trailing the Russell 2000. The average market capitalization of a company listed in the Russell 2000 index is currently $2.76 billion. Well-known stocks that are part of the index include clothing retailer Abercrombie & Fitch (ANF), semiconductor company Onto Innovation (ONTO), and grocery retailer Sprouts Farmers Market (SFM).

Is The iShares Russell 2000 ETF a Buy?

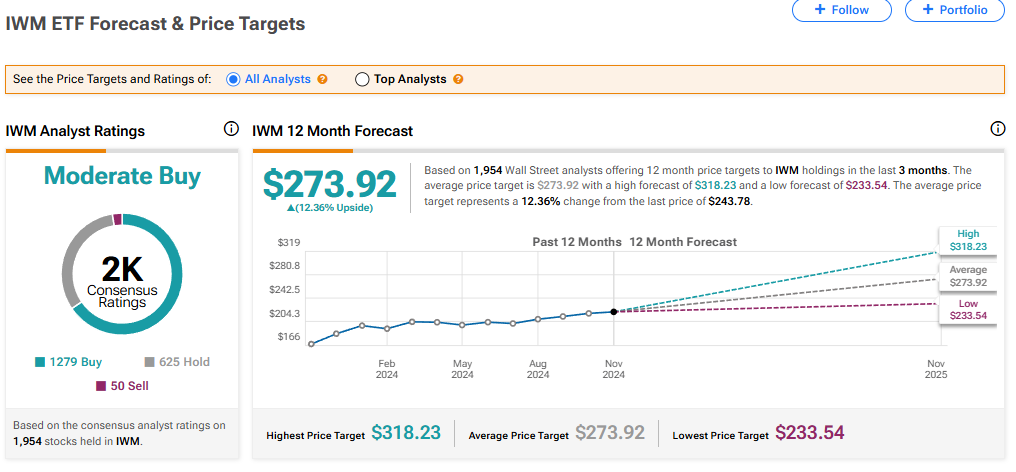

The iShares Russell 2000 exchange-traded fund (IWM), which tracks the small-cap index, has a consensus Moderate Buy rating among 1,954 Wall Street analysts. That rating is based on 1,279 Buy, 625 Hold, and 50 Sell recommendations issued in the last three months. The average IWM price target of $273.92 implies 12.36% upside from current levels.

Read more analyst ratings on the IWM ETF

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue