Shares of Royal Caribbean Cruises are rising over 2% in the pre-market trading on Tuesday after the company’s executives forecasted higher demand for cruises in 2021, following upbeat 2Q revenue results. The cruise stock jumped 10% on Monday.

Royal Caribbean (RCL) is expecting higher demand and “remarkable” bookings for its international cruises next year, despite wider-than-expected 2Q losses and higher cash burn per month. “We have been both humbled and surprised with the amount of bookings we’re seeing for 2021 with literally no marketing efforts.” as was stated by Royal Caribbean CEO Richard Fain on the earnings call.

Royal Caribbean reported 2Q revenues of $175.6 million, topping analysts’ estimates of $47.4 million by a wide margin. Revenues, however, fell 93.7% year-over-year, as cruises remain suspended due to the coronavirus pandemic. The company reported loss of $6.13 per share in 2Q versus analysts’ loss expectations of $4.82 and earnings of $2.54 in the year-ago quarter. Amid a prolonged suspension of operations, the company expects average cash burn of about $250 million to $290 million per month, higher than the earlier cash burn guidance of about $250 million to $275 million, provided during 1Q.

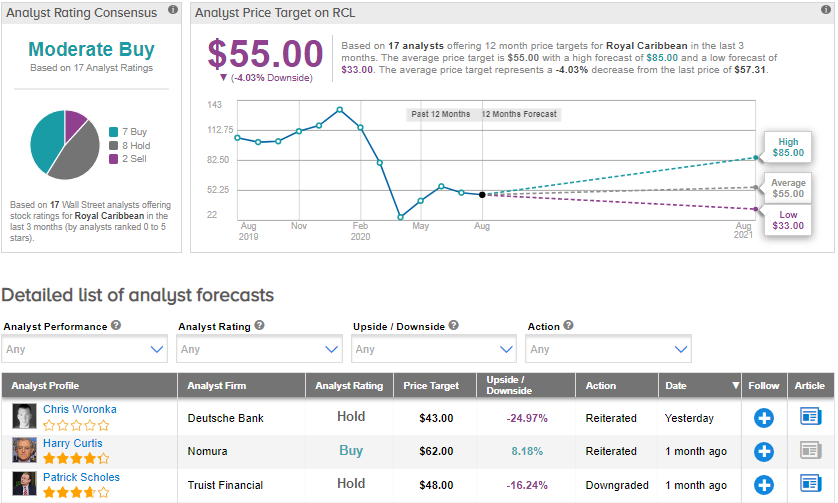

Following the results, Deutsche Bank analyst Chris Woronka stated that according to RCL, “bookings for 2021 are within normal historical ranges for this time of the year. However, he estimates it to be “well less than half of forward year bookings are typically made by this point.” He maintained a Hold rating and a price target of $43 (25% downside potential) on the stock and expects “operations to remain paused through at least October.”

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 7 Buys, 8 Holds, and 2 Sells. The average price target of $55 implies a downside potential of about 4.0%. (See RCL stock analysis on TipRanks).

Related News:

American Airlines Shares Lifted By Air Travel Demand Data

RBC Raises TripAdvisor’s PT On Improving Demand Outlook

UBS Lifts United Parcel’s PT On ‘Favorable’ Pricing Environment