Royal Caribbean Cruises has extended the suspension of cruise sailings until Nov. 30, excluding sailings from Hong Kong. The cruise operator has taken the decision due to the COVID-19 crisis, which has dented the demand for voyages.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Royal Caribbean (RCL) said that its cruise brand Celebrity Cruises will suspend the full 2020/21 winter program in Australia and Asia. Its Azamara cruises will also cancel their 2020/21 winter sailings throughout Australia & New Zealand, South Africa and South America.

On Aug. 10, the company reported 2Q loss of $6.13 per share, which was larger than analysts’ loss expectations of $4.82. The 2Q revenues of $175.6 million, however, surpassed the Street consensus of $43.5 million. (See RCL stock analysis on TipRanks)

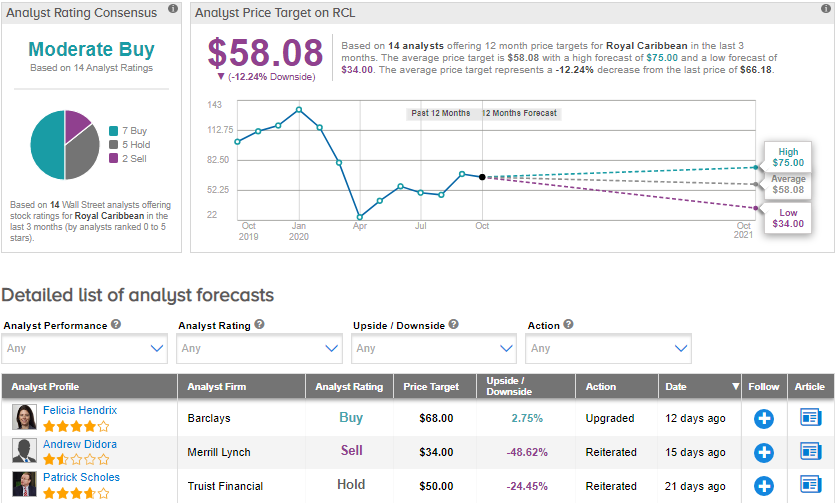

On Sept. 25, Barclays analyst Felicia Hendrix upgraded the stock to Buy from Hold, saying that risk/rewards in the cruise space are very attractive in the U.S. leisure sector. She maintained a price target of $68 (2.8% upside potential).

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 7 Buys, 5 Holds and 2 Sells. The average price target of $58.08 implies downside potential of about 12.2% to current levels. Shares have declined by about 50.4% year-to-date.

Related News:

Carnival To Sell Two Princess Cruises Ships; Street Stays Firmly Sidelined

Boeing Drops 7% On Trimmed Aircraft Demand Outlook

Accenture To Buy Myrtle To Improve Supply Chain Capabilities