Roth Capital raised Gogo’s price target to $10 (35.7% upside potential) from $8, following the company said that it will sell its commercial aviation (CA) business to Intelsat S.A.

On Sep. 1, in-flight internet company Gogo (GOGO) said that it is selling its CA business to Intelsat, the world’s largest global satellite operator, for $400 million in cash. Gogo is expected to close the deal before the end of the first quarter of 2021. Further, it plans to utilize the deal proceeds to reduce its debt and invest in growth opportunities such as Gogo 5G.

Gogo’s CEO Oakleigh Thorne said that “This transaction creates a stronger and more focused Gogo, with the singular strategic imperative of serving the business aviation market with the best inflight connectivity and entertainment products in the world.” (See GOGO stock analysis on TipRanks).

Roth Capital analyst Scott Searle said that “this transaction is transformative as it removes the headwinds of CA EBITDA losses related to COVID ($79M in 2020E), and unlocks Business Aviation (BA) value which features strong profitability (45%+ EBITDA margins) and a leadership position (~90% share) in an underpenetrated (25%) and growing (10%+) market.” He maintained a Buy rating on the stock.

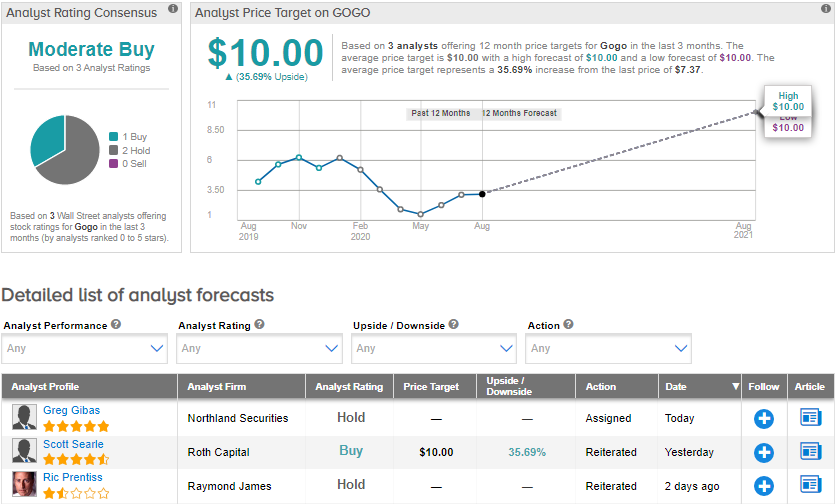

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 1 Buy and 2 Holds. The average price target of $10 implies upside potential of 35.7% to current levels. Shares are up by over 15% year-to-date.

Related News:

Gogo Pops 21% On $400M Intelsat Deal For Commercial Aviation Biz

Macy’s Pops 6% As 2Q Revenue Surprises

H&R Block Drops After 1Q Revenue Miss