American off-price retailer Ross Stores (NASDAQ:ROST) stock jumped over 6% in extended trading yesterday after registering a healthy earnings beat. The company’s second-quarter Fiscal 2023 results surpassed Wall Street estimates on both the top and bottom lines.

Ross Stores reported diluted earnings of $1.32 per share, significantly better than analysts’ estimates of $1.16 per share. Similarly, sales of $4.93 billion easily outpaced the consensus of $4.72 billion. In the prior- year period, ROST reported diluted earnings of $1.11 per share on sales of $4.58 billion.

What’s more, the company impressed shareholders by raising its outlook for the second half and full year of Fiscal 2023, which also beat Wall Street expectations.

Ross Stores’ Upbeat Guidance

Ross Stores caters to the lower and mid-income levels of consumer groups, which are equally pressured by sticky inflation. Even so, the discounted items offered by the off-price retailer seem to be attracting customers to its stores for bargain purchases.

Based on the superb quarterly performance, ROST increased its guidance for both Q3 and Q4 as well as for Fiscal 2023. Comparable store sales for Q3 and Q4 are expected to grow by 2%-3% and 1%-2%, respectively.

For Q3, diluted earnings are expected in the range of $1.16 to $1.21 per share, while consensus is pegged at $1.18 per share.

For Q4, diluted earnings are projected between $1.58 and $1.64 per share, and for Fiscal 2023, earnings could now come in the range of $5.15 and $5.26 per share. Remarkably, Ross Stores’ Fiscal year 2023, ending on February 3, 2024, includes one extra week compared to FY22.

Is Ross Stores a Good Stock to Buy?

Encouraged by the discount retailer’s Q2 print and improved guidance, Guggenheim analyst Robert Drbul raised the price target on ROST stock to $135 (19.4% upside) from $125 while maintaining a Buy rating.

Drbul believes Ross Stores is well positioned to benefit from the favorable environment for off-price retailers. The analyst noted that ROST opened 27 new stores and remains on track to open the targeted 100 new stores in the Fiscal year. Plus, the retailer’s inventories decreased by 15%, another sign of efficient management. Moreover, Ross Stores continues on its mission to buy back $950 million worth of shares this Fiscal year, with $230 million worth of shares bought back in the second quarter.

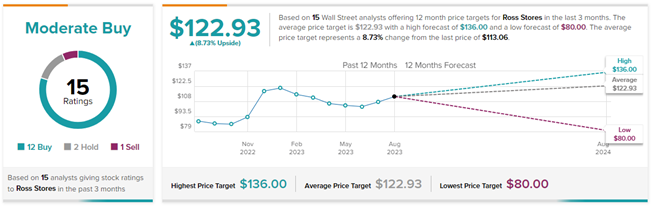

Overall, analysts remain cautiously optimistic about ROST’s trajectory. With 12 Buys, two Holds, and one Sell rating, ROST stock has a Moderate Buy consensus rating. On TipRanks, the average Ross Stores price forecast of $122.93 implies 8.7% upside potential from current levels.