Shares of Ross Stores were down 3.1% in Wednesday’s pre-market trading session after the off-price retailer delivered lower-than-expected 4Q FY20 (ending Jan. 30, 2021) results due to the adverse impact of the COVID-19 pandemic. Moreover, Ross Stores provided 1Q earnings guidance that fell short of analysts’ expectations.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Ross Stores (ROST) reported 4Q earnings of $0.67, which declined 47.7% year-over-year and fell short of analysts’ estimates of $1.00 per share due to lower sales and operating margins.

Revenues declined 3.7% to $4.25 billion in 4Q, which lagged the consensus estimate of $4.27 billion. Comparable store sales declined 6% as pandemic-led restrictions negatively affected the holiday selling season.

The company’s CEO, Barbara Rentler, said, “the upsurge of the virus resulted in lower traffic, especially in California, our largest state, where we were subject to more stringent occupancy and operating hour restrictions.”

Operating margins declined from the last-year period, “as an increase in merchandise margin was more than offset by the deleveraging effect on expenses from lower sales, and higher supply chain and COVID-related operating costs,” said Rentler. (See Ross Stores stock analysis on TipRanks)

Following the earnings, Guggenheim analyst Robert Drbul raised the stock’s price target to $130 (10.5% upside potential) from $125 and maintained a Buy rating. In a note to investors, the analyst said, “We believe ROST’s exposure to the off-price channel and its domestic growth opportunity warrant a premium multiple.” He added, “ROST will emerge in a stronger competitive position following the COVID-19 disruption.”

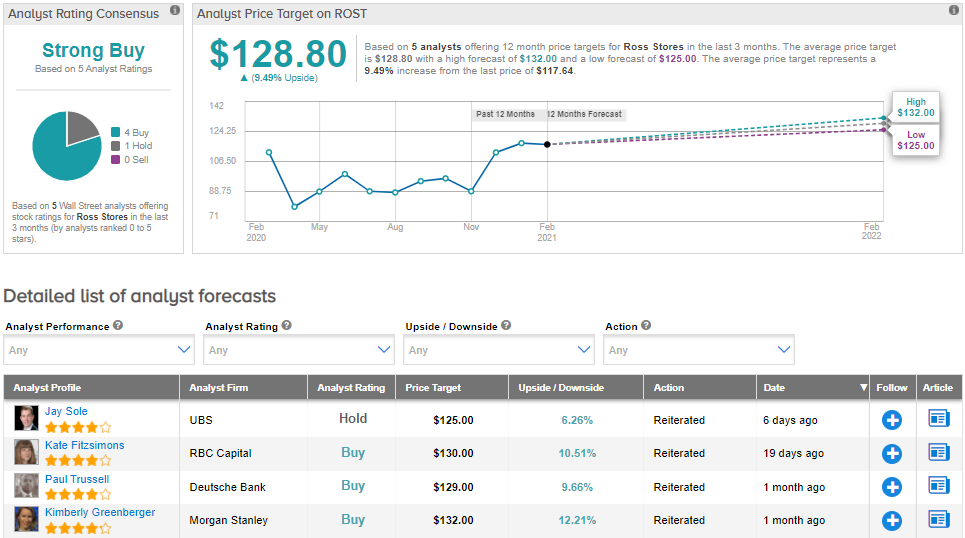

Overall, the Street has a Strong Buy consensus rating on the stock based on 4 Buys and 1 Hold. The average analyst price target of $128.80 implies upside potential of over 9% to current levels. Shares are up around 11% over the past year.

Related News:

Box’s 4Q Profit Soars 214%; Street Sees 14% Upside

B&G Foods Drops Over 6% On 4Q Earnings Miss

AutoZone’s Domestic Same Store Sales Fuel 2Q Beat; Street Is Bullish