Roku is in advanced talks to snap up Quibi’s content catalog, the Wall Street Journal reported citing a source familiar with the matter. However, the video streaming platform did not disclose the potential acquisition price.

Quibi is a short-form streaming service, which was launched in April 2020 to develop high-end content for mobile phones. However, then in October, the company had reportedly been planning to shut down the operations and sell its assets, as the service never took off the way it desired.

The WSJ report said that Roku (ROKU) is aggressively investing into content, and therefore, the Quibi acquisition would provide its own ad-supported app, the Roku Channel, exclusive access to Quibi’s library of shows and programs.

Last month, Roku reached a deal with AT&T’s WarnerMedia for HBO Max subscribers to stream movies or shows on its devices from Dec. 17. (See ROKU stock analysis on TipRanks)

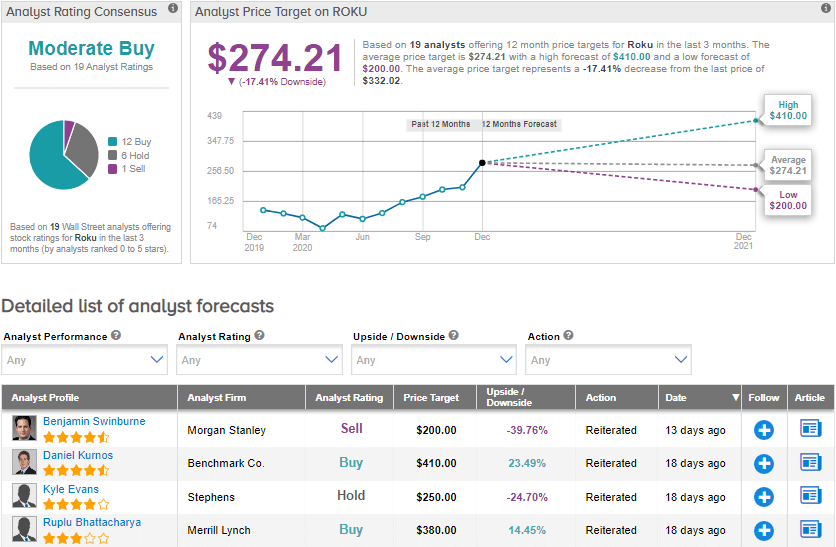

Following the HBO deal, Benchmark Co. analyst Daniel Kurnos lifted the price target to $410 (23.5% upside potential) from $300 and maintained a Buy rating on the stock. In a note to investors, Kurnos said that the HBO deal will help the company generate a “significant” upside versus his expectations.

Meanwhile, the average price target stands at $274.21, which indicates downside potential of 17.4%. Shares have already soared about 148% in 2020.

Currently, the Street is cautiously optimistic about the stock, with a Moderate Buy analyst consensus based on 12 Buys, 6 Holds and 1 Sell.

Related News:

Roku Gains 4.5% On HBO Max Streaming Deal; Stock Up 143% YTD

Discovery Rolls Out Streaming Service On Amazon Fire TV And Roku – Report

Verizon Settles Price Dispute With Hearst Television – Report