One of the biggest names around when it comes to streaming infrastructure has to be Roku (NASDAQ:ROKU). Those little boxes definitely punch above their weight in providing streaming value. However, a new report that retail giant Walmart (NYSE:WMT) may be poised to shake up the field by buying smart TV maker Vizio (NYSE:VZIO) is leaving some very concerned. With the market about to close for the day, Roku itself is up a little over 1.5%.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The deal in question suggests that Walmart might end up buying Vizio. That’s a move that could have serious implications for Roku, but both positive and negative possibilities exist, according to word from KeyBanc analyst Justin Patterson. Roku is very much a big part of Walmart’s ecosystem of low-priced televisions. However, so is Vizio. And if Walmart gets control of Vizio, Patterson notes, there could be a strain on Roku’s device sales and overall customer count. Still, Walmart in control of Vizio might prove a welcome boost for Roku, offering “some valuation support for Roku’s installed base.”

Opinions Vary All Over

Not all analysts looked for positive outcomes, though; Matt Farrell with Piper Sandler was looking for Roku to lose ground in such a move. Meanwhile, other reports suggested that there would be little for Roku to worry about here, as Vizio was a “fringe platform player” at best, and the whole thing sounded a bit too familiar considering Walmart’s acquisition of Vudu back in 2010. Finally, the fact that Roku has already fended off the likes of Apple (NASDAQ:AAPL) and Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) makes it pretty clear that it can likely handle Walmart, too.

What Is a Good Price for Roku Stock?

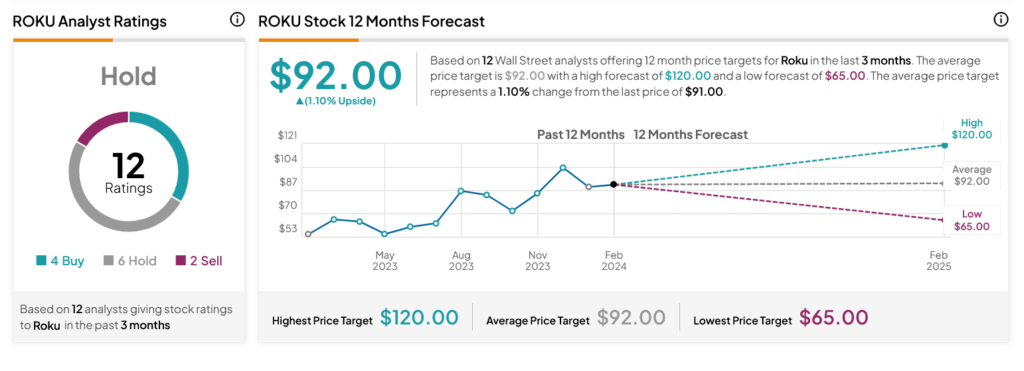

Turning to Wall Street, analysts have a Hold consensus rating on ROKU stock based on four Buys, six Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 0.59% rally in its share price over the past year, the average ROKU price target of $92 per share implies 1.1% upside potential.