Swiss pharmaceutical giant Roche (RHHVF) is racing to fast-track its weight loss drugs, aiming to challenge rivals in the booming anti-obesity market. After sharing this encouraging news, Roche’s stock jumped 6%, showing that investors are excited and that competition is heating up in the industry.

Fast-Tracking Weight Loss Treatments

Roche’s CEO, Thomas Schinecker, told the Financial Times that the company’s first weight loss drugs might hit the market by 2028, coming in ahead of schedule. These treatments, snagged in Roche’s $3.1 billion buyout of biotech Carmot last year, feature a weight-loss shot moving into phase II trials and a pill that’s already reduced weight by 6.1% after just four weeks compared to a placebo. Looks like Roche is aiming to shake up the weight loss scene!

Roche’s Competitive Edge

Schinecker pointed out that Roche’s pill, made synthetically, might give it a leg up over the peptide-based drugs from rivals like Novo Nordisk (NVO). But don’t get too excited just yet—analysts are holding their breath. Emily Field from Barclays said, it’s too early to tell if the company would be able to “disrupt the head start Novo and Lilly have.”

Growing Obesity Market

The obesity market is projected to soar past $130 billion by 2030. Roche is diving into this booming field, taking on heavyweights like Novo Nordisk (NVO) and Eli Lilly (LLY), whose drugs have led to weight losses of 15% and 20% respectively, according to CNBC. Despite a few bumps along the way, Roche is honing in on its most promising drugs and plans to merge its new treatments with existing ones for related issues.

Is Roche Stock a Good Buy?

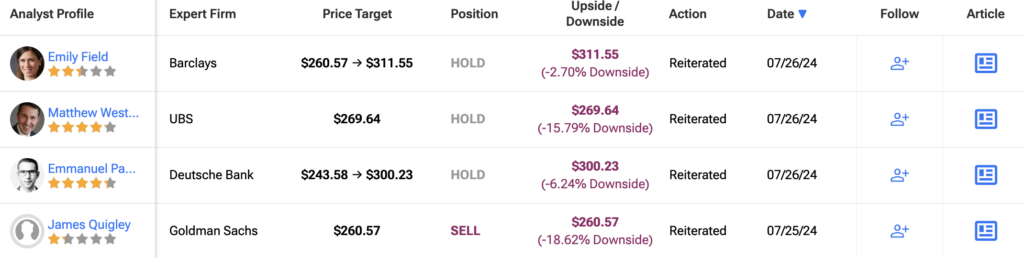

As the weight loss drug scene heats up, it’s a good idea to see what price target analysts are giving Roche Holding. Analysts are cautious about RHHVF stock, with a Hold consensus rating based on four Buys, five Holds and three Sells. Over the past year, Roche has increased by 3.3%. The average RHHVF price target is $306.45, implying a downside potential of 4.29%.