Roche (GB:0QOK) has snapped up Ireland-based Inflazome in a share purchase agreement worth €380 million. Inflazome’s shareholders will also be eligible to receive additional contingent payments based on the achievement of certain milestones.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Founded in 2016 by medical researchers, Inflazome is developing oral inflammasome inhibitors to address clinical unmet need in inflammatory diseases.

Following the acquisition, Roche will receive full rights to Inflazome’s entire portfolio of clinical and preclinical orally available small molecule NLRP3 inhibitors. Roche intends to further develop NLRP3 inhibitors across a wide variety of indications with high unmet medical need.

Matt Cooper, CEO of Inflazome, commented: “With Inflazome now part of the Roche organization, Inflazome’s pioneering molecules are well positioned to be developed quickly and effectively so they can help patients suffering from debilitating diseases.”

Inflammasomes are understood to drive many chronic inflammatory conditions, from Parkinson’s and Alzheimer’s to asthma, inflammatory bowel disease, chronic kidney disease, cardiovascular disease, arthritis and NASH.

The company, which has raised €55m in venture capital financing, owns a portfolio of orally available small molecule NLRP3 inhibitors, with lead molecules having successfully completed Phase I clinical trials, as well as several high potential earlier-stage programs.

According to Inflazome, activated NLRP3 acts as a ‘danger sensor’ in the body to release the pro-inflammatory cytokines IL-1β, IL-18 and induce uncontrolled, lytic cell death. These processes lead to chronic inflammation, and as such, NLRP3 has been implicated in many diseases. (See Roche stock analysis on TipRanks).

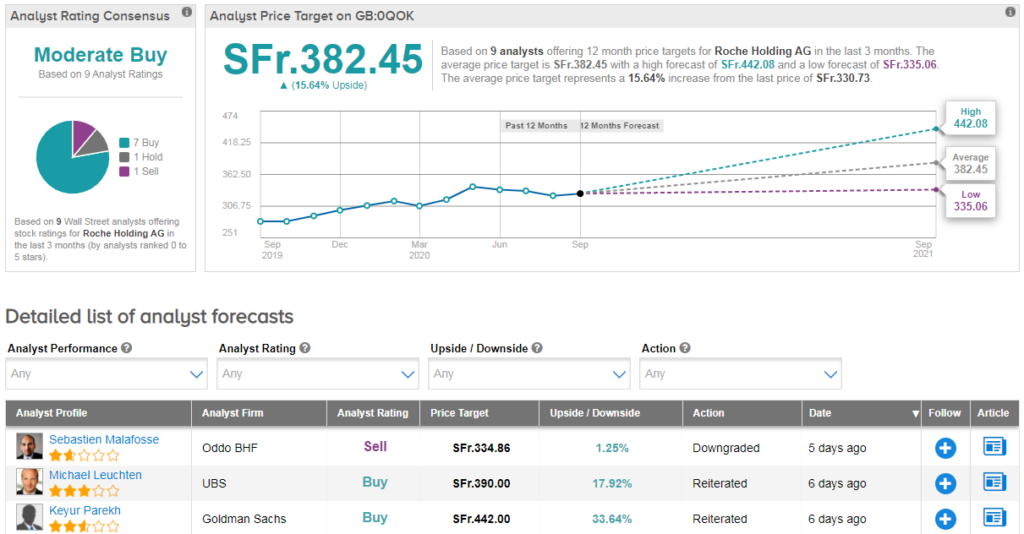

From the Street, Roche scores a cautiously optimistic Moderate Buy Street consensus with 7 recent buy ratings offset by 1 hold rating and 1 sell rating. Meanwhile the average analyst price target of SFr.382.45 indicates 16% upside potential from current levels.

Most recently, Oddo BHF analyst Sebastien Malafosse took the rare step of double-downgrading Roche, citing the upcoming US presidential elections. With 48% US sales exposure, the analyst sees risk to Roche’s growth potential if there is a democratic presidential win.

Related News:

J&J Kicks Off Phase 3 Covid-19 Vaccine Trial With Single Dose

RedHill Gets Brazil’s Nod For Covid-19 Study With Opaganib

Gilead’s Filgotinib Arthritis Drug Scores Europe, Japan Approval