Since the early months of 2022, staffing agency Robert Half (NYSE:RHI) has struggled. A robust jobs market combined with a hawkish monetary policy bode rather poorly for RHI stock. However, the Federal Reserve could potentially offer relief. It’s a risky narrative but one that isn’t entirely without merit.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Sure, the outside circumstances don’t seem auspicious in the least. The May nonfarm payrolls revealed that employers added 272,000 jobs. That was a big leap from April’s print of over 165,000. Further, the latest tally exceeded economists’ consensus view of 182,000 jobs. Ordinarily, a robust labor market is good for society – that is, if you’re not fighting a blistering inflation problem.

Unfortunately for the Fed, more gainfully employed people translate to more dollars chasing after fewer goods. That only contributes to the inflationary dilemma, meaning that the central bank will likely keep rates steady. However, that doesn’t favor businesses, which may seek to save money rather than spend it.

Still, the nuances of other economic reports suggest that policymakers have a legitimate reason to be dovish. If so, Robert Half could be very intriguing, making me bullish on RHI stock.

For RHI Stock, Bad News Could be Good News

Fundamentally, market observers who covered the May jobs report generally viewed the matter as good news being bad news. Yes, it’s wonderful that people who apparently want work can quickly find it. At the same time, this dynamic also means that the influx of consumer dollars may drive up prices.

For RHI stock stakeholders, however, bad news for the economy could be good news for Robert Half. Essentially, if white-collar workers have more difficulty finding satisfactory employment opportunities, they may turn to professional staffing agencies. Further, the collective difficulty may inspire the Fed to lower interest rates, boosting business sentiment and commercial spending.

While the headline numbers seemingly work against RHI stock, the nuances appear to support the underlying bullish narrative. Sure, we may be seeing robust job growth, but as TipRanks reporter Paul Hoffman stated, a dichotomy exists between economic indicators and public sentiment.

Contrasting with the mainline employment numbers are other datapoints that reflect pessimism: soft income and spending data, lower-than-expected manufacturing sentiment, and corporations sounding the alarm about eroding consumer spending. In other words, quite a few sectors exist that need help. Therefore, the Fed actually wouldn’t be unjustified in providing some relief in the form of interest rate cuts.

If so, that could boost sending in various commercial sectors. Essentially, the dollar would become more devalued, meaning that it would make sense for companies to invest their dollars – such as hiring new workers to support expansionary initiatives.

Such a framework would likely extend a lifeline to Robert Half, making RHI stock a contrarian idea.

Robert Half Is Surprisingly Resilient

At the moment, analysts are very pensive about RHI stock overall. Few give it a chance to succeed, and some are downright bearish on the enterprise. Still, as a consensus, Robert Half’s expected sales growth rate demonstrates surprising resilience.

For example, Verified Market Research believes that the global recruitment and staffing market may rise from a valuation of $474.61 billion in 2023 to $553.91 billion in 2031. If so, that would represent a compound annual growth rate (CAGR) of 1.95%.

In contrast, Robert Half posted revenue of $6.39 billion last year. By 2026, experts believe that the company may ring up sales of $6.87 billion. That would imply a CAGR of 2.44%. That’s not raging growth by any means. However, even with analysts being largely skeptical about RHI stock, it’s expected that the underlying firm will outpace its industry.

Not only that, but it’s worth noting that experts have previously cast doubts on the staffing industry as a whole. However, they’ve been proven wrong, with the sector rising above expectations. That being the case, investors may want to give RHI stock a second look.

The experts may be making the wrong assumption again, this time regarding interest rate cuts and their timing.

Valuation Nuances to Consider

Presently, RHI stock trades at a trailing-year revenue multiple of 1.11x. That’s just a hair over the staffing and employment service sector’s average sales multiple of 1.08x. Given Robert Half’s brand power – particularly in the finance and accounting realms – one could make the argument that RHI is well-priced.

However, analysts project that Fiscal 2024 revenue will land at $6 billion, which would represent a 6.1% decline from last year’s top line of $6.39 billion. Under this framework, concerns exist that RHI stock is more of a value trap. Still, the matter may come down to monetary policy.

If the Fed is more dovish in its policy messaging than the market is expecting, that could gin up sentiment. As mentioned above, legitimate reasons exist for the central bank to be more accommodative. Basically, it comes down to the labor market not being quite as strong as advertised.

Is Robert Half Stock a Buy, According to Analysts?

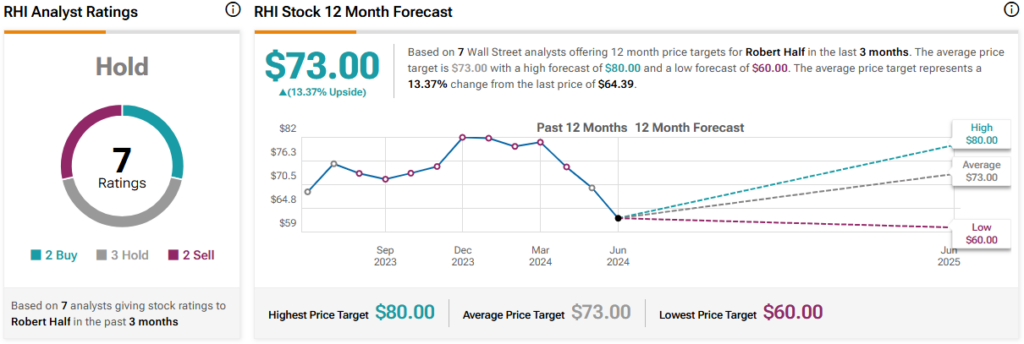

Turning to Wall Street, RHI stock has a Hold consensus rating based on two Buys, three Holds, and two Sell ratings. The average RHI stock price target is $73.00, implying 13.4% upside potential.

The Takeaway: RHI Stock Could be More Relevant Than People Think

On the surface, Robert Half seems to be struggling with a relevancy problem. The job market is doing great, and therefore, the Fed is in no mood to lower interest rates. However, the nuances reveal that certain sectors are struggling in the economy. Therefore, legitimate reasons exist for reducing borrowing costs. If the central bank becomes more accommodating relative to consensus views, RHI stock could be a surprisingly good deal.