Shares of electric vehicle maker Rivian Automotive (NASDAQ:RIVN) dropped over 15% in Wednesday’s extended trading session. The decline comes after the company reported a wider-than-expected loss for the fourth quarter and provided weak production guidance for 2024.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Furthermore, RIVN disclosed plans to lay off about 10% of its salaried workforce. The move comes in response to a softening of EV demand, prompting Rivian to take measures to manage costs.

Q4 Snapshot

The company reported a loss per share of $1.58, which compares unfavorably with the consensus estimate of a loss of $1.35 per share. However, the quarterly loss was down from $1.87 in the year-ago quarter. Meanwhile, Q4 sales increased by 98.3% year-over-year to $1.32 billion and surpassed the analysts’ expectations of $1.28 billion.

During the quarter, RIVN’s production and delivery increased by 75.1% and 73.5%, respectively, year-over-year. In Q4, the company incurred a gross loss of $43,373 per unit delivered to customers, down significantly from $124,162 in Q422.

Q1 and 2024 Outlook

RIVN expects to produce 13,500 units in the first quarter. Also, it expects a 10% to 15% sequential fall in total deliveries in Q1.

For 2024, the company anticipates that adjusted earnings before interest, taxes, depreciation, and amortization will remain negative at $2.7 billion. This reflects Rivian’s continued investment in marketing initiatives and the development of its R2 vehicle, partly offset by cost-cutting measures.

Further, Rivian expects to produce 57,000 vehicles in 2024, compared with 57,232 EVs in 2023.

Is Rivian a Buy, Sell, or Hold?

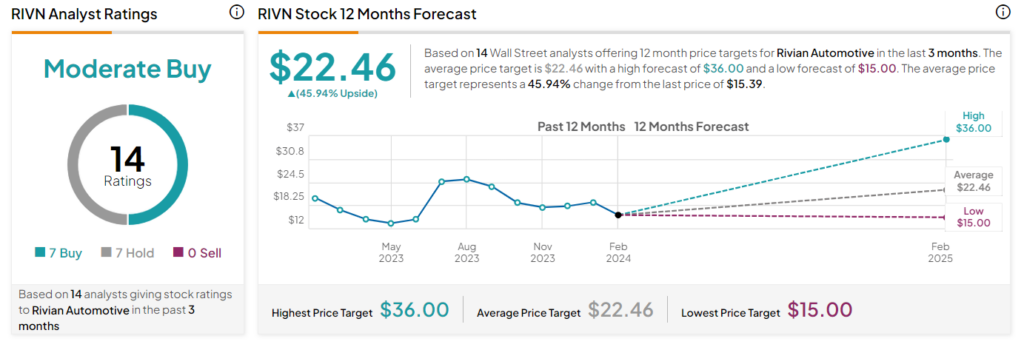

On TipRanks, Rivian stock has a Moderate Buy consensus rating based on seven Buys and seven Holds. The average stock price target of $22.46 implies a 45.9% upside potential. The stock is up nearly 24% over the past six months.